On Your Radar for 2026: The Must-Watch Trends From 2025

Explore three of the top export and commodity finance trends going into 2026, with news, in-depth articles, deals data, and event content curated by Exile Flow AI. Green projects remain strong, security moves beyond defence into energy and mining, and trade finance faces a shrinking pool as lenders pull back.

Trend 1: Big-ticket green industrial projects still have a lot of momentum

Despite headwinds and setbacks, big-ticket green industrial projects still have a lot of momentum in export finance.

Quick links & content:

Riding the gusts: Poland progresses offshore wind ambitions

Baltyk II & Baltyk III Offshore Wind Farm Projects

Fengmiao 1 Offshore Wind Project

Green ECA Financing: Catalysing the Transition to a Sustainable Economy

Trend 2: Security is at the core of ECA activities and not just through defence deals

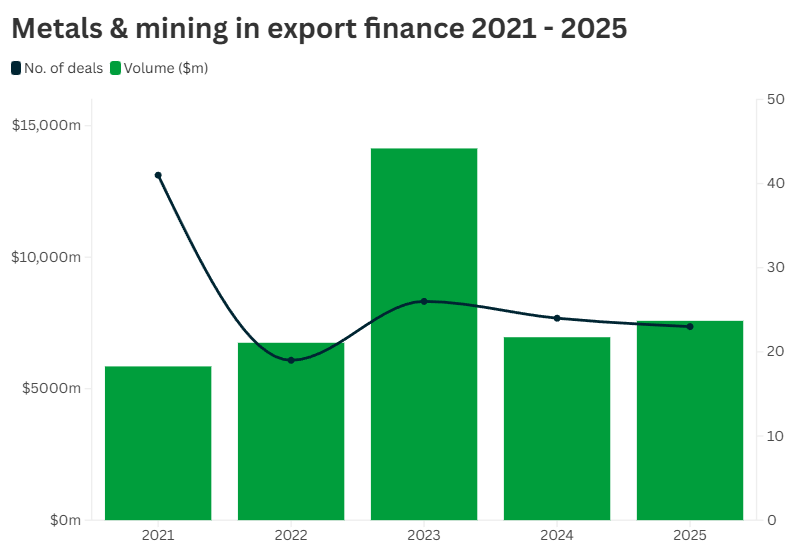

Security is at the core of ECA activities, and not just through defence deals. Power (both traditional and renewable) and mining are now also significant areas of interest, although turning talk into action is proving difficult.

Quick links & content:

As demand for critical minerals grows, ECAs are increasing support with 2025 Q1-Q3 activity surpassing all of 2024.

Keynote: EKN’s new head, Nordlander, on continuity, change and defence

Americas 2025 Opening Keynote: US EXIM BANK

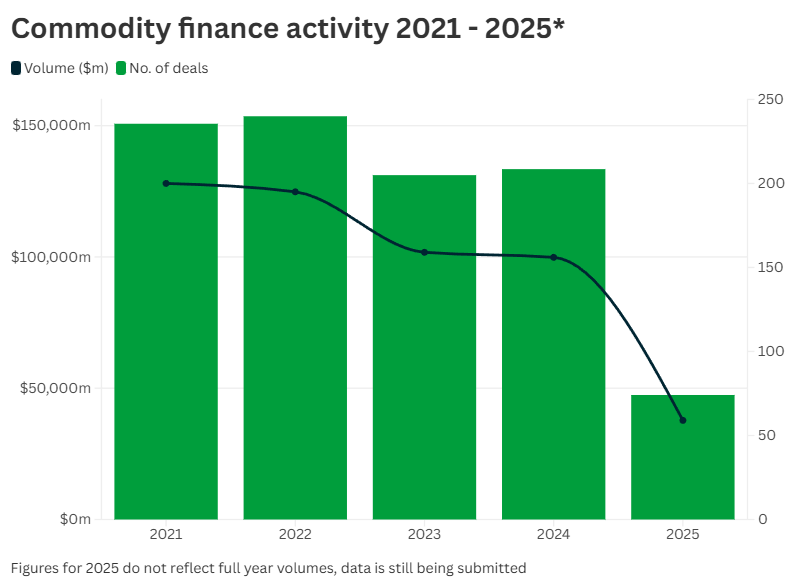

Trend 3: The pool of trade finance continues to shrink

The pool of trade finance continues to shrink with the withdrawal of a number of alternative lenders, and traditional commodity lenders are focusing on their core clients due to geopolitical headwinds and risk perceptions.

Quick links & content:

Commodity finance has been slow this year due to low prices, tighter bank lending, stricter regulations, and weak demand, mainly favouring only the largest traders.

Atishoo: Non-bank trade finance trio catch a cold

Trading Forward: Adapting strategies in an ever-changing landscape

These findings were curated through Exile Flow. Get access to further real-time deals data, recent news, articles, and event content for each trend with our secure AI tool.

Try it out for Trend 1 here

For even more trends and in-depth analysis, check out our Festive Trends podcast episode: