Uzbekistan fires energy ambitions with CCGT upgrades

Uzbekistan’s growing energy market provides plenty of opportunities for infrastructure development, and ECAs are showing enthusiasm. Gas remains essential to its ecosystem, but Uzbekistan’s ambitions in hydrogen have helped to offset any concerns over long-term fossil fuel financing.

Uzbekistan’s energy market is heating up but ECAs remain wary of fossil fuel infrastructure. Growing demand for power must be met by fresh investment in ageing energy networks, and ECAs are in theory well-placed to provide.

Combined-cycle gas power is proving a popular choice for governments looking to balance their environmental commitments with the realities of their grid infrastructure. An ECA-backed deal for the 550MW Jizzakh power plant in Uzbekistan demonstrates that debt is still available for fossil fuel facilities in emerging markets – albeit with the promise of a hydrogen-powered future.

The export financing itself amounts to a 12-year €164.25 million ($185.78 million) buyer credit that benefits from a 95% Euler Hermes guarantee. DZ BANK and DenizBank are the only lenders on the ticket. DZ acted as bookrunner and coordinator, as well as ECA and ESG agent, while DenizBank acted as the facility agent. Baker McKenzie provided legal counsel. Cengiz Enerji approached DZ BANK and DenizBank directly for support on the project as a long-term client of the banks. Jebsen & Jessen, an historic German trading house with significant experience in ECA-backed transactions, provided supply chain services and bundled deliveries from a group of manufacturers.

The borrower, Cenergo, is the Uzbek subsidiary of Cengiz Holding, a Turkish conglomerate. Jizzakh represents its third major project following the delivery of two other natural gas power plants in Tashkent (240MW) and Syrdarya (220MW). However those projects were brownfield developments funded on balance sheet. This deal represents the company’s first greenfield debt raising in Uzbekistan.

The 550MW Jizzakh combined cycle power plant will generate electricity for 1.6 million households. It is a significant investment in Uzbekistan’s ageing energy apparatus, much of which is still reliant upon Soviet-era technology.

The National Electric Grid of Uzbekistan holds a 25-year PPA for the project, while fuel will be sourced from domestic suppliers. Commissioning is expected on 1 January 2027.

Crucially, the state-of-the-art technology from Siemens Energy underpinning the plant is H2-ready, and with additional upgrades it will be able to co-fire with a hydrogen fuel mix. Siemens Energy was awarded a contract for the delivery of a gas turbine in 2023. In practice this feature will not be utilised for the foreseeable future, since Uzbekistan has little in the way of domestic renewable hydrogen infrastructure.

The government has developed a strategy to place green hydrogen at the centre of its energy plans and a number of projects are at pilot stage. Most notably, ACWA Power is set to begin production at a 20MW electrolyser near Tashkent that will produce 3000 tonnes of green hydrogen annually. The first phase, which includes a 52MW wind farm, has been supported by a $65 million senior loan from the EBRD. Phase two includes plans to produce 500,000 tonnes of ammonia annually.

The hydrogen component was critical to the success of the Jizzakh financing, even if this remains a natural gas project. ECA-backed financing for the fossil fuel industry has largely dried up in recent years, for none more so than European agencies. A consistent pipeline of oil & gas deals is maintained for associated infrastructure like FPSOs, as well as for upgrades to existing downstream facilities.

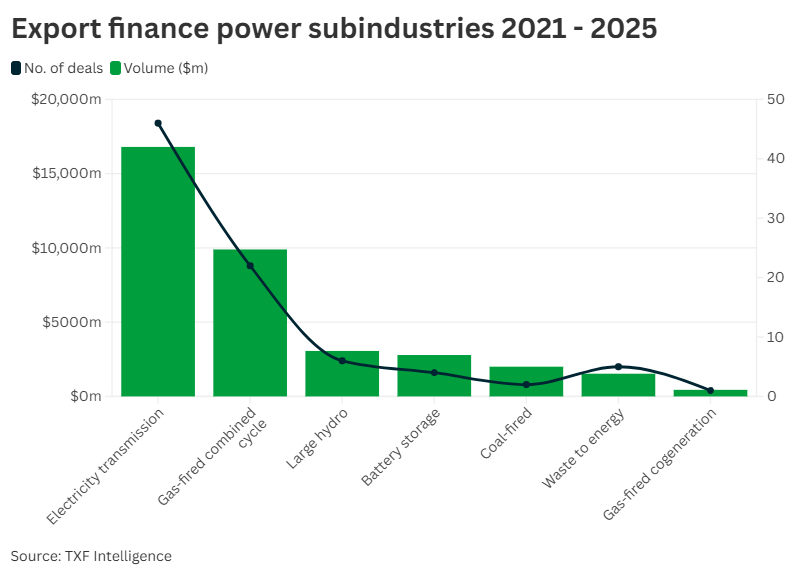

Similarly, financing for CCGTs is available but restricted. According to TXF Intelligence, ECAs have backed 16 deals for CCGT projects since 2022, largely located across Central Asia and Mexico. They are designated transitional infrastructure by lenders and ECAs. Under the ICMA Green Bond Principles Jizzakh is “green enabling” and it meets the EU Taxonomy’s “do no significant harm” criteria.

In other words, new gas-fired technology can significantly reduce a country’s carbon emissions profile, even if it is not carbon neutral itself. The benefits of this are felt most in the developing world, where power facilities are ageing and renewables cannot be implemented without accompanying upgrades to grid infrastructure.

Molecules are still critical to the emerging market energy mix. Uzbekistan does not have sufficient grid capacity to distribute electricity directly from renewable energy projects. It maintains a target of developing 25GW in renewables capacity by 2030, or roughly 40% of its overall power mix. CCGTs are necessary to provide reliable baseload power while the rollout of electrons takes place.

Yet even with this in mind, European ECAs have largely avoided the power industry. CCGT financing is dominated by JBIC and Sinosure, both of which have expressed fewer qualms over the reputational risks attached to fossil fuels. In 2023, JBIC supplied close to $400 million in direct loans alongside a NEXI guarantee for another Uzbek CCGT facility – the 1580MW Syrdarya II project.

Euler Hermes’ support in this case is predicated on the 2023 modernisation of the OECD Arrangement’s Climate Change Sector Understanding (CCSU).

In 2023 the CCSU was widened to include mitigation schemes like hybrid power plants in recognition that ECAs must be encouraged to support a wider range of project classes. In the absence of renewable hydrogen technology, the participation of Euler Hermes would have been in doubt, if not out of the question.

Meanwhile the political climate around the world perhaps looks more favourably today on fossil fuel power than it has done in recent years. The Jizzakh deal marks Euler Hermes’ second Uzbek CCGT transaction in the past 12 months, having never previously completed such a deal.

The 1.6GW Surkhandarya CCGT project secured a major ECA/DFI-backed debt package in December 2024. A consortium led by QuWatt, Nebras Power, Siemens Energy and EDF secured a €1.2 billion deal featuring buyer credits from Euler Hermes and Credendo, loans from AIIB, IsDB, ICD and OPEC Fund, and further investment guarantees from the German government.

Here the scale of the transaction necessitated DFI involvement. The Jizzakh financing benefited from a close existing relationship between the borrower and the lenders, as well as Euler Hermes’ recent experience in the sector. Cengiz has a strong balance sheet as a developer with international business interests. Familiarity between the participants enabled them to overcome initial challenges around the project’s emissions profile.