Keynote: ECIC’s expanded mandate in focus with acting CEO Maphula

TXF speaks to Ntshengedzeni Gilbert Maphula, acting CEO of Export Credit Insurance Corporation of South Africa (ECIC), about South Africa’s export credit agency’s structure and strategy going forward with the new focus of its expanded mandate.

TXF: Can you paint a picture of ECIC’s activities in terms of sector and country support and areas of concentration. How are your priorities changing?

Ntshengedzeni Gilbert Maphula ( NGM): At the end of our financial year in March 2023, the total sum insured was R17.04 billion (equivalent to US$956.7 million). Our top three exposures are Ghana, Zimbabwe and Ethiopia at 47%, 26% and 8%, respectively. Our top economic sectors are electricity (encompassing projects in generation, transmission and distribution) as well as construction (various infrastructure, such as roads, health facilities, dry ports).

NGM): At the end of our financial year in March 2023, the total sum insured was R17.04 billion (equivalent to US$956.7 million). Our top three exposures are Ghana, Zimbabwe and Ethiopia at 47%, 26% and 8%, respectively. Our top economic sectors are electricity (encompassing projects in generation, transmission and distribution) as well as construction (various infrastructure, such as roads, health facilities, dry ports).

Under the expanded mandate, we have been receiving enquiries from other markets in West Africa and this is broadening our experience, although it’s unlikely to have a significant impact on our portfolio.

TXF: What are the biggest challenges/frustrations facing project and export finance in Africa – how are you handling them?

NGM: 1) ECIC as an active participant of SA Inc is often affected by the sovereign credit rating for South Africa. This has an impact on all-in-costs for projects.

2) There are different legal frameworks on the continent and this impedes progress on a project especially where there are a number of ECAs participating in the same project. Intense negotiations are key in harmonising those differences and this has worked well on some of the projects.

3) In efforts to mitigate commercial risk, ECIC assumes a large portion of the risk with financiers carrying a minimum of 15% of the risk.

4) Environmental, Social and Governance (ESG) issues – We have incorporated an ESG function, which will enable us to identify these risks and monitor them throughout the project lifecycle and be on the forefront of green economy and the climate change risks.

TXF: Do you think there’s an issue with concentration risk in terms of geographies (Ghana and Zimbabwe) – and sectors (power, construction) – if so, how are you trying to diversify?

NGM: While we acknowledge that the bulk of ECIC’s exposure is in those two countries, there is a split in projects between private (corporate & project finance) and sovereign (i.e., those with a backstop to government). ECIC also has a risk appetite framework that sets single obligor and sector limits.

We also try to diversify, through reinsurance and by taking exposure in other economic sectors. Noteworthy [is] each deal is considered on a merit basis, and strategic intent.

TXF: ECIC has been given an expanded mandate to make South Africa exporters more attractive to international investors – how is that working?

NGM: The expanded mandate kicked off with ensuring that the new unit set up with guiding strategy, processes, procedures, plus the introduction of the Trade Credit Insurance product (which is the key product offered to the exporters by private insurers), among others.

Following approval by our Board, we are currently at implementation stage and this will also incorporate an information and communication technologies (ICT) system to ensure quick turnaround times.

To date, we continue to underwrite transactions for working capital and bonds and these form part of the expanded mandate.

TXF: How is your product suite evolving and how will changes to the OECD Arrangement help?

NGM: ECIC now covers downpayments and we have expanded to insure short term products, including trade credit insurance

TXF: Can you expand on the kind of support you are offering to SMEs. How successful has this been?

NGM: We are revisiting the enquiries previously received, particularly clients who require cover for trade credit insurance. Through collaboration with our shareholder, the Department of Trade, Industry and Competition (the dtic), we are participating in African Continental Free Trade Area (AfCFTA) engagements in different provinces where a wider audience of SMEs is reached. We support the Black Industrialists programme as well.

TXF: How do you view cooperation with international ECAs going forward?

NGM: Cooperation with international ECAs is important to the ECIC strategy. Reinsurance and cover of non-SA financial institutions are material matters being tabled with key decision makers.

Engagement with the Berne Union is part of our Stakeholder Engagement Plan. We just hosted the 6th BRICS Heads of ECA meeting and identified opportunities for ECIC to benefit from ECAs of other member states.

We recently signed MOUs with Saudi Exim and Etihad Credit Insurance, and we are in the process of finalising another with Export Guarantee Fund of Iran. These countries have recently joined BRICS.

TXF: Are geopolitical concerns a hindrance to ECIC strategy?

NGM: Whilst our business is a function of geopolitical and economic circumstances, our strategy will always focus on transactions with managed risk allocation and that are deemed important in the host country, with mutual benefits.

TXF: What is your deal pipeline looking like and what’s exciting you?

NGM: Our pipeline is vibrant and diverse, covering almost every region of Sub-Sahara Africa. We are seeing a huge [increase in] new mining transactions, in countries such as Tanzania and Zimbabwe and in rail infrastructure in Angola and DRC.

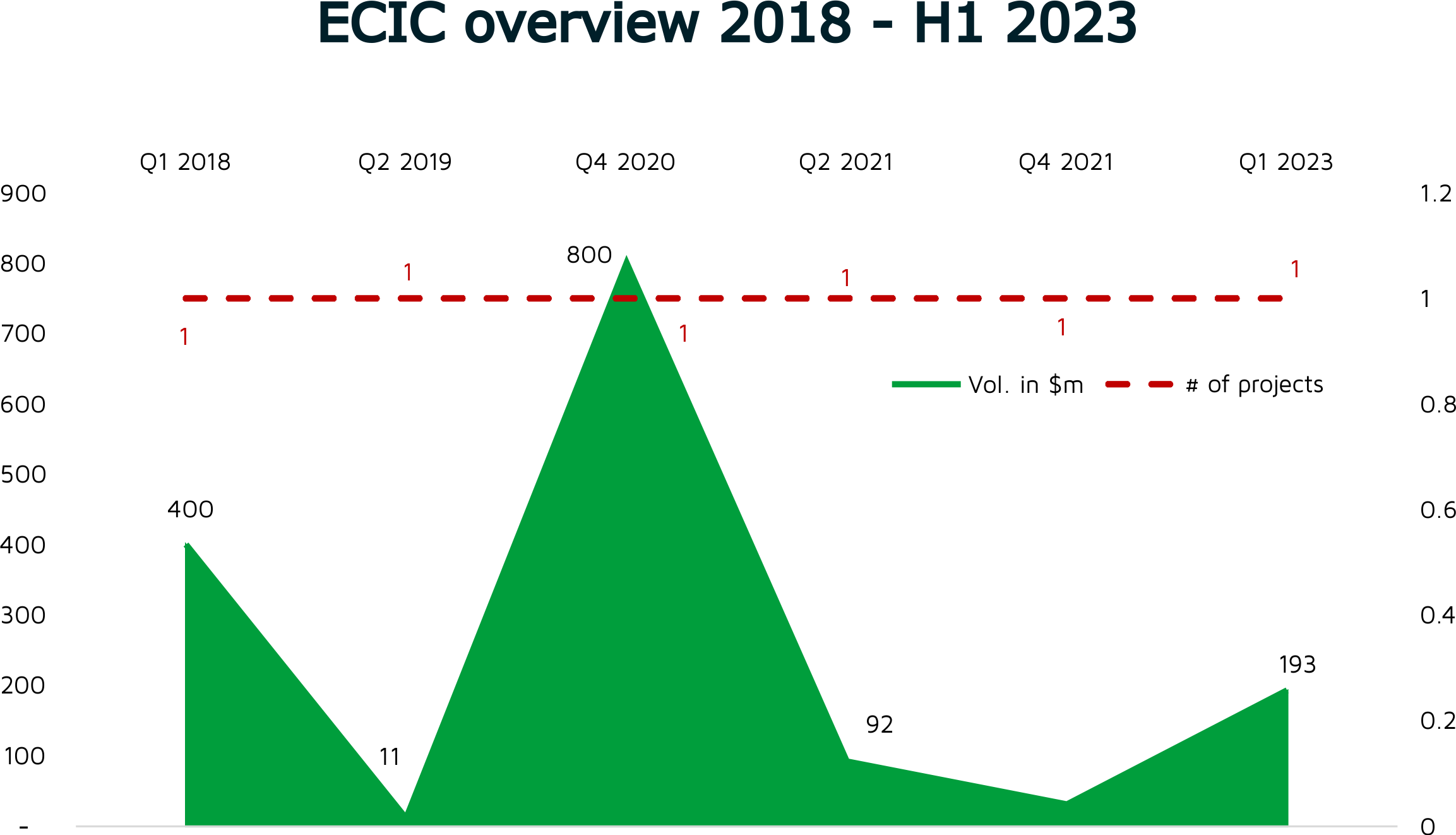

Source: TXF Intelligence

Ntshengedzeni Gilbert Maphula has been in the role of acting CEO since the untimely loss of CEO Mandisi Nkhulu in July, who had been at ECIC for 22 years.