From idea to reality: Acre’s Export Finance Funds

Acre Impact Capital previewed the launch of its Export Finance Funds at TXF & Uxolo’s Global Conference 2023 in Lisbon. The first-of-its-kind strategy plans to bring impact investors, DFIs and commercial banks onto the commercial tranche of climate-aligned ECA transactions and, if successful, could give export finance’s sustainability credentials a much-needed boost.

Acre Impact Capital (Acre) is first and foremost an impact-led asset manager, known by many for its White Papers on leveraging ECAs for impact investing and sustainability in export finance. It is now looking to put those White Paper ideas into practice. At TXF, Proximo & Uxolo’s Global 2023 conference in Lisbon, Acre previewed the launch of its strategy, which aims to invest in the 15% short tenor down-payment tranches of export finance transactions, with an initial focus on Africa.

Acre founding partners Hussein Sefian and Faisal Khan believe there is untapped potential for export finance in emerging markets, because unlike in project finance, where institutional investors are reliant on the success of construction for future revenue generation, export finance investors are only required to take credit risk against the borrower. In most cases in Africa, this would be via the sovereign’s debt-management office, such as the Ministry of Finance, which pays interest on principle regardless of the project. ECAs are also already highly experienced in assessing ESG risk, assuring fund investors of a thorough due diligence process.

Each dollar invested by the fund will aim to unlock up to $5.60 in capital mobilisation. The fund’s impact themes are all climate-aligned, ranging across renewable power; health, food and water scarcity; sustainable cities; and green transportation. Acre has already developed its own impact measurement system, leveraging the Impact Management Project methodology. It will be using the GIIN IRIS+ methodology to define the specific metrics of any given project, and is also a signatory to the GIIN/IFC Operating Principles for Impact Management.

Acre has been backed by The Rockefeller Foundation and PIDG’s GuarantCo and their support was described by Chris Mitman, head of export and agency finance at Investec and incoming managing partner and head of origination at Acre, as the fund’s catalyst: “That patient, trusting capital – the fund needed that big leap of faith from these big players”. Investec, Industrial Development Corporation of South Africa, EIB are also backing the fund, which is continuing to attract interest from other commercial and impact investors, DFIs and MDBs.

Matching investors with impact

The fund’s investors slot into three distinct buckets; the first is development financiers, the DFIs and MDBs whose development mandate is focused on ensuring that projects build essential climate aligned infrastructure on the continent, create jobs, and stimulate economic activity. The second bucket is the commercial investors, perhaps already active as arrangers in the export credit market, which see the fund as a mechanism not only to bring more export products and services onto the continent but also to deliver on their sustainability ambitions. The third bucket comprises the impact investors and impact-driven family offices. Whilst individually these players represent smaller ticket sizes, as an aggregate they are of vital importance; if successful, the fund will be able to bring a vast pool of private capital into the continent where there are currently limited pathways to invest.

Widespread sustainability is something which came relatively late to the framework of export credit agency-backed financing, particularly when compared to the spearheading of DFIs on all matters green. It was in fact Acre and International Financial Consulting’s landmark ICC White Paper on sustainability in export finance that gave the market its first “real shot in the arm”.

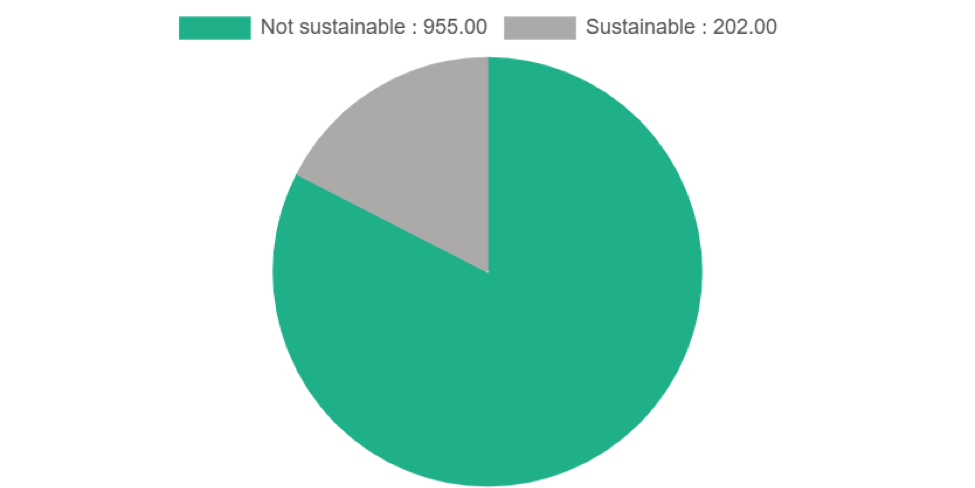

There has been staggered progress on this front since, including the modernisation of the OECD agreement which, as one of many updates, expanded the scope of green or climate-friendly projects eligible for longer repayment terms. However, according to TXF data, for the past three years only 17.45% of ECA deals have been sustainable, as visible from the graph below. As Mitman notes in the interview, “I think the topic of sustainability has come from left field to centre field, and everyone's struggling to react to that, both at a corporate level as well as a transaction level.”

Source: TXF Data

All three buckets of the fund’s investors will be unwaveringly set on green and social deals only, and whilst it's unlikely to transform the market overnight, this new source of calculated buyers will be another driver of sustainable deal origination for ECAs. Khan confirms as much in the interview, stating, “Acre wants to be at the forefront of that [sustainability] evolution, and hopefully what we are doing now in 12 -18 months time will be the market standard.”

The Uxolo perspective

The fund promises an attractive alternative for the export buy-side: while investors could put $20-$50 million into one deal, the fund’s open platform grants access to 15-20 deals at the same commitment level, as well as a diversified portfolio of credit risk, exposure, and massively leveraged impact exposure.

On a deeper level, Mitman made clear that the fund’s purpose is not to chuck money at projects, but instead for it to channel investment into “ideas”. And threading impact dollars into export finance, if carried off successfully, is a good idea, because as Mitman notes, while “the export credit market has been incredibly good at risk assessments”, it's been less good at articulating the output of a given project, good or bad, once it starts operating.”

Although Acre’s holistic approach to impact measurement will be new to the export finance sector, even having just one player measuring impact like this will influence the market. As Sefian outlines, “as you start to build this [impact intentionality] discipline into the market, you start to influence project design upstream.” And in terms of measuring the fund’s future success, “that really will be the ultimate win”.

The other measure of the fund’s future success will be how many private sector debt investors take a piece of it. Traditional commercial project lenders have been pulling back from providing the 15% uncovered down-payment on ECA deals – an upfront hole that borrowers have to bridge to generate 85% ECA cover under OECD rules – for anything other than stellar credits. That retreat is putting ECA cover beyond the reach of many projects in developing markets; projects that might otherwise have been financed.

Filling that funding gap with DFI debt would do little to alleviate the pressure on already stretched DFI lending budgets. Consequently, while the EIB’s recent $40 million commitment to Acre’s Export Finance Fund 1 is a vote of confidence, having considerably more private sector than DFI debt in the fund – which is feasible given the short tenors the fund would be investing in – would be a strong indication of scalability beyond the traditional confines of DFI lending constraints: in short, pulling in more commercial lend into the blend in blended finance.

In conversation with...

Click on the video link or read condensed highlights below from Uxolo’s interview with Acre’s founding partners Hussein Sefial and Faisal Khan, and Chris Mitman, head of export and agency finance at Investec, which is an anchor investor Acre Impact Capital Export Finance Fund.

Uxolo: You recently previewed the launch of export finance fund strategy. Could you tell us a bit about what Acre is, what it's doing in the export finance market, and what this new fund is all about?

Hussein Sefian (HS): To introduce Acre Impact Capital, we are an impact investment manager and really our mandate is to invest in climate-aligned infrastructure projects across the African continent. Our strategy is very unique to the export finance market because we really look to invest alongside ECAs and specifically in the commercial loan tranche of export credit transactions on the African continent. As you know, capacity for financing on that tranche is not always available. So really the idea for this fund is to be additional to the market and provide a new source of capacity for that commercial tranche, through impact capital.

As an impact investor, we are investing both for financial returns as well as environmental and social impacts. And we focus on four different impact themes: renewable power; health, food and water scarcity; sustainable cities; and green transportation.

Uxolo: Acre is backed by the Rockefeller Foundation and PIDG, and your investors include impact investors and African banks. Could you tell us about this combination of backers and why this makes sense for Acre and the export finance market?

Faisal Khan (FK): We were supported early on by Rockefeller Foundation with a grant, and that's how we started our journey initially as that helped us develop our concept and the business plan behind it. Further on in that journey, Rockefeller was joined by PIDG, which saw the catalytic nature of the fund and how we could unlock more private capital in a continent where access to hard currency financing was already very limited. So with these two very strong backers, one, a reference point in the impact space and the other one a reference point in the development space, we were able to go out there and position ourselves very positively with strong investors such as, as you mentioned, EIB.

I think you would have heard from the market that we are an open platform for banks and other institutions to show us their deals. But I would say that we're also an open platform for investors and those investors who wouldn't necessarily have access to this particular investment class will do so through Acre.

Chris Mitman (CM): The road that these guys have been on is the road less travelled, or possibly not travelled at all in that the easiest route when you're fundraising is to go to commercial investors looking for impact allocations to meet their investment targets. It was a very deliberate strategy adopted by the founding partners here on either side of me to crowd in DFIs, impact investors and African specialists. If you want an informed investor class which really understands what they're trying to do, that takes more time, mandate, alignment. A whole bunch of things needs to be achieved, but the end result is a growing selection of investors who will make it sustainable for the long-term.

Uxolo: Who are Acre’s customers? Will you be competing with export finance banks or ECAs? Could you give us a feel for how you will interact with the market?

CM: As a career banker it's been a rapid education for me to understand the world of funds and how they interact. We have two sets of customers: on the one side, we've got our investor clients over here who are the development banks, the impact investors, the African credit specialists who we are continuing to fundraise and bring into the fund.

On the other side, the way the fund is going to work is to cooperate and collaborate with banks and ECAs. The fund is here to fundamentally be additional to the market to fill gaps and be complementary to the market. We are a relatively small team - here to fund. That's what we do. We don't arrange, we don't perform agency roles. So the bank's role is still very much originate. Find the deals, structure. The deals apply for cover signed term sheets with borrowers, and then they want to look for lenders to come into those deals.

FK: Just to add to that from an investor standpoint, this market is not very easily accessible for institutional investors, the ones that we discussed earlier on. And I think what this platform does is provide them with easy access to this market, and one where they're dealing with a fund manager that not only knows the credit on the ground, African credit, but also specialises in impact. They’re getting returns both on the commercial credit returns, but also impact returns, so we're catering to both sides of the scale.

CM: A really good point, Faisal. I think the topic of sustainability has come from left field to centre field, and everyone's struggling to react to that, both at a corporate level as well as a transaction level. I think Acre is going to do a couple of things apart from funding these commercial insurances, it's going to bring to bear expertise on how to classify transactions and assess them appropriately for environmental and social impact. We have our own matrixes to do that and our measurement tools and those tools and insights will be available to arranging banks to share. So that's a value add because a lot of arranging banks will not have embedded these experts into their teams, it’s just transaction by transaction.

The other benefit I guess, that needs to be articulated is that not every bank in fact, most banks don't have big distribution teams to distribute export credit and commercial debt. You need flow. Only a handful of banks have the sufficient flows to sustain the size of distribution teams, which allows them to reach a lot of investors, which Acre is crowding in through its investor base.

Uxolo: To continue on that point about impact investment, you will probably be best positioned to answer how impact is going to be threaded into the export finance market and whether this is even viable. How are you going to get institutional investors comfortable taking on construction risk, for example?

HS: In terms of how we sort of explain the environmental and social risks to investors, we have outlined a very robust environmental and social management system for the fund which really goes into a lot of detail around how we expect to manage these risks, including construction risk, and what safeguards we are putting in place.

In order to do that, we built on industry frameworks, like the IFC Performance standards and the Equator principles and so on. But in addition, we added our own lens, taking a very strong climate lens as well as a very strong gender lens on the transaction to make sure that we cover all of the aspects, including some of these topics that are not sort of always well thought through in terms of these lenses.

When you think about impact, investors accessing the export finance market is very challenging because you can either go into a commercial loan or you can try to go on the covered tranche. With the latter, there are only a few large banks that recycle that risk with institutional investors; it’s a relatively rare activity and most banks will keep it on the balance sheet. But, to our knowledge, there is no other fund that focuses on the cover tranche and this is not a space that most institutional investors are comfortable with. So for better or worse, the export finance market has very much remained a banked market. And what we're trying to do with the fund is open up a small window for institutional investors and impact investors to participate in that market and bring additional liquidity to it.

CM: It's about convergence and the platform has become a point around which DFIs and impact investors can converge with export finance players. It's a brave investor who tries to step into the world of export finance and decide which one of these deals is credible for me to go into. They've delegated authority to us to make those investment decisions for them and to curate the transactions, decide what's the best combination of ECAs, banks, EPC contractors and so on and so forth, to actually make those transactions happen.

The other point to realise is that if these investors go and deal by deal, they're going to put $10, $20, $30, $40, $50 million into one market and into one deal. If they put $50 million into the fund, it's going to go out into 15-20 deals and possibly that many markets, they get diversification of credit risk, credit exposure, also massively leveraged impact exposure across multiple sectors that Hussein outlined before. And then, whatever the size of the fund, that is going to get multiplied by 5.6 times as the privately funded export credit debt is released. So a $50 million investment in Acre could release several billion dollars worth of impact projects on the continent.

Uxolo: Has the ICC’s white paper on sustainability helped provide more collective terminologies and definitions to better interpret the raft of different metrics to measure sustainability and the SDGs?

HS: What you often hear in the industry is that there are too many methodologies, metrics, frameworks etc. to determine what is sustainable and as a result, nothing gets done. I think a lot of people use this as an excuse not to have a disciplined approach when looking at transactions and measuring their potential impact.

What the White Paper has shown very clearly is that within the bank market there is already a consensus around how to think about sustainability which is the green loan, social loan and sustainability linked loan principles which banks use to classify transactions and issue relevant bonds. Is it the best framework? Maybe, maybe not. Will it evolve? Of course. Maybe just to shift on the impact space, what we see in the impact space is that there is already a general understanding of how to think about impact and how to measure impact to the global impact.

FK: I'm particularly excited about having our ESG advisory committee as part of our fund which will be populated by people such as the European Investment Bank, such as IDC and such as some of the small, really impact oriented family offices that are that are coming into the fund and that will create a forum for discussion between the banks, the developmental world and the impact world.

CM: It's about being able to articulate impact. I think the export credit market has been incredibly good at risk assessments, but what it's been less good at articulating is the output of that project, good or bad, once it starts operating. And that's what impact is all about.

Uxolo: With these impact methodologies, do you think the more they are used, the easier it is going to be to structure new deals with impact as an intention rather than just an output?

HS: What we're hoping to achieve is really bringing that intentionality in terms of project design, where you can look at any piece of infrastructure and look at how to optimise the design for better impact. If you’re looking at a construction site for a hospital, that will mean asking how can we make sure that female workers on the site have the required facilities? How can we make sure that the health and safety environment caters for the needs of male workers and female workers? How can we ensure that women have opportunities in management and senior management? Similarly, when we look at the design of the hospital, is the hospital optimised for reducing energy efficiency and therefore carbon emissions?

In my mind, as you start to build this discipline into the market, you start to influence project design upstream so that when you're designing the project, you're looking at all of the potential impacts and optimising impact across the value chain, both in the construction phase but also in the design of the infrastructure and on the operation phase. That to me is really the ultimate win.

Uxolo: What innovations have been made around covering the 15% down payment traditionally needed on an export credit when the private market can’t absorb the residual risk?

CM: It's one of the stimulants for the fund being set up. There really hasn't been a lot of innovation so far in other sources of capital being used for the 15%. That's because it's been an insurance led solution. So private risk mitigation capacity has been sought by banks who have then funded that tranche. I think since 2008, however, there's been a steady trend of attacks by the regulators on the use of leverage by banks, and I speak as a career banker. Banks have areas of core focus and competency: I am very comfortable as a bank funding loans against my own ECAs’ guarantee because I understand them. They're my local government or their EU government or a US government guarantee there to promote national trade interests. First and foremost. They're in it not to lose money, but to promote national trade.

So am I keen to go into a deal in a market where I’m not present, just because there's insurance available from the commercial market? That's more of a nuanced call. Have people tried to bring in new sources of investors? I think for super large deals you can do it. We've seen super sized infrastructure deals where we have to because of the scale, you've seen individual DFIs, ECAs and commercial lenders come together to put a two $3 billion deal together because you need that level of support. For smaller deals, absolutely not.

HS: In our process, we spoke to 600-plus investors, both asset managers active in emerging markets, as well as more institutional pension funds and so on. What we found is that a lot of investors cannot get into commercial loans for various reasons. Typically mandate format, they can only get into traded liquidity traded securities. They can't get into loan instruments, due to the time that it takes to close deals. What investors typically want is a transaction that will close tomorrow, settle in three days.

For all of these reasons, it's very hard on a deal by deal basis to bring in an institutional investor into a commercial loan. It takes a lot of effort for an investor to get comfortable with all of these unknowns; you would only do it if there's a constant deal flow and you want to get into that, or as an institutional investor, like the investors in our fund, you want to really capitalise this market and also learn from the fund how the market operates.