Credit Suisse-UBS: The TXF perspective

The UBS takeover of Credit Suisse has shaken Europe’s banking sector, with many wondering what will come next. A restructuring process is already underway as the banks look to shed unprofitable business. With the prospect of credit withdrawal looming, TXF Intelligence has taken a look at the data on Credit Suisse and UBS activity across export and commodity finance.

These are nervous times for the grandees of Europe’s banking sector. Two pillars of Switzerland’s financial ecosystem have become one, and the ripples have undermined investor confidence across the continent. Financial institutions have faced rapid share sell-offs amid social media rumours of an impending banking crisis. In the last week, political leaders have stepped forwards to stop the rot, with Deutsche Bank stumbling under the pressure of a 28% drop in share price. The optics of the UBS takeover of Credit Suisse are poor; this is a collapse in the heartlands of Europe’s much-lauded financial powerhouse. The long term decline of a major Swiss bank also speaks to the ongoing failings of the banking ecosystem, now 15 years on from the financial crisis. At this moment in time, officials have been seemingly successful in calming choppy waters. However, the outlook for the near future is precarious, to say the least.

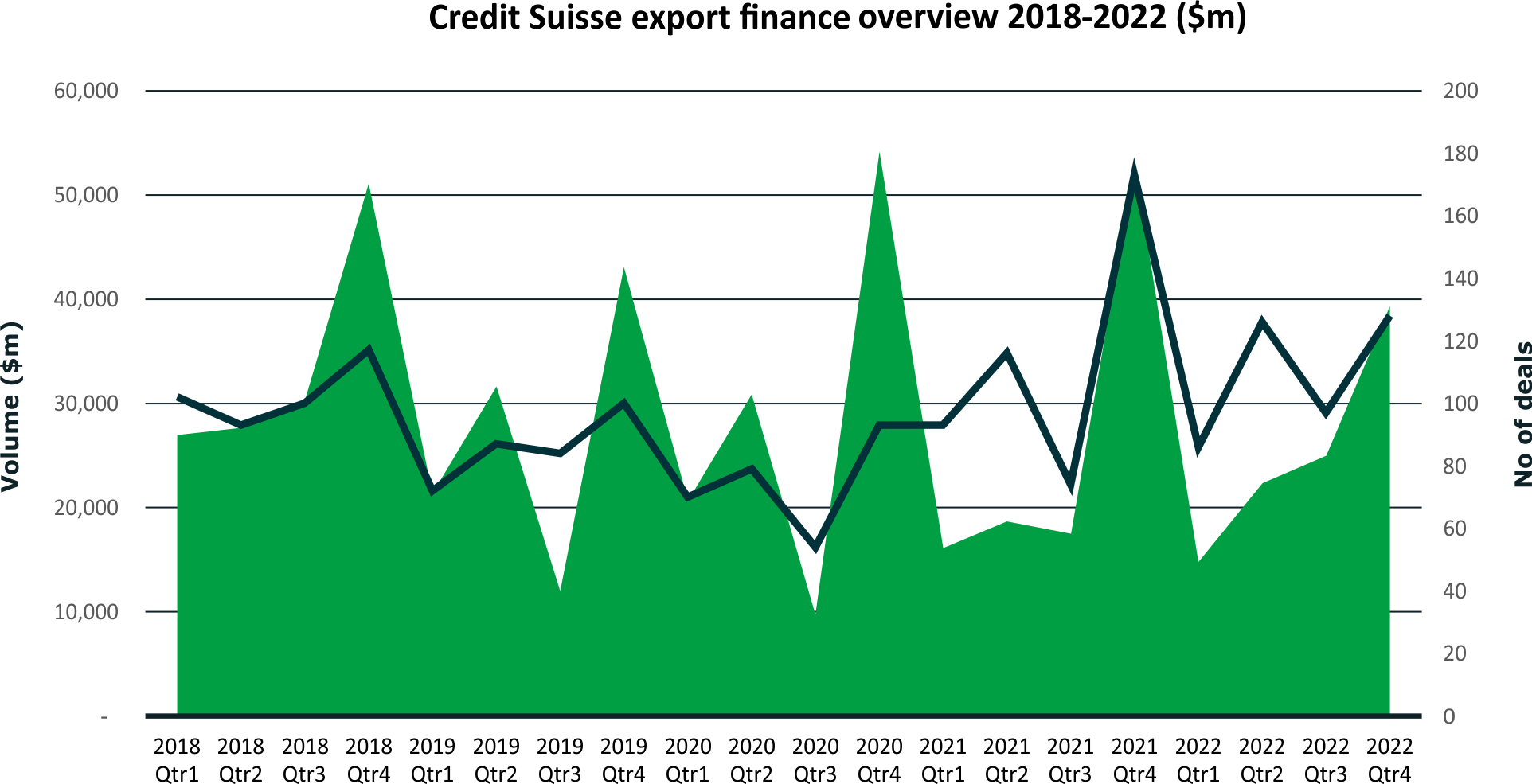

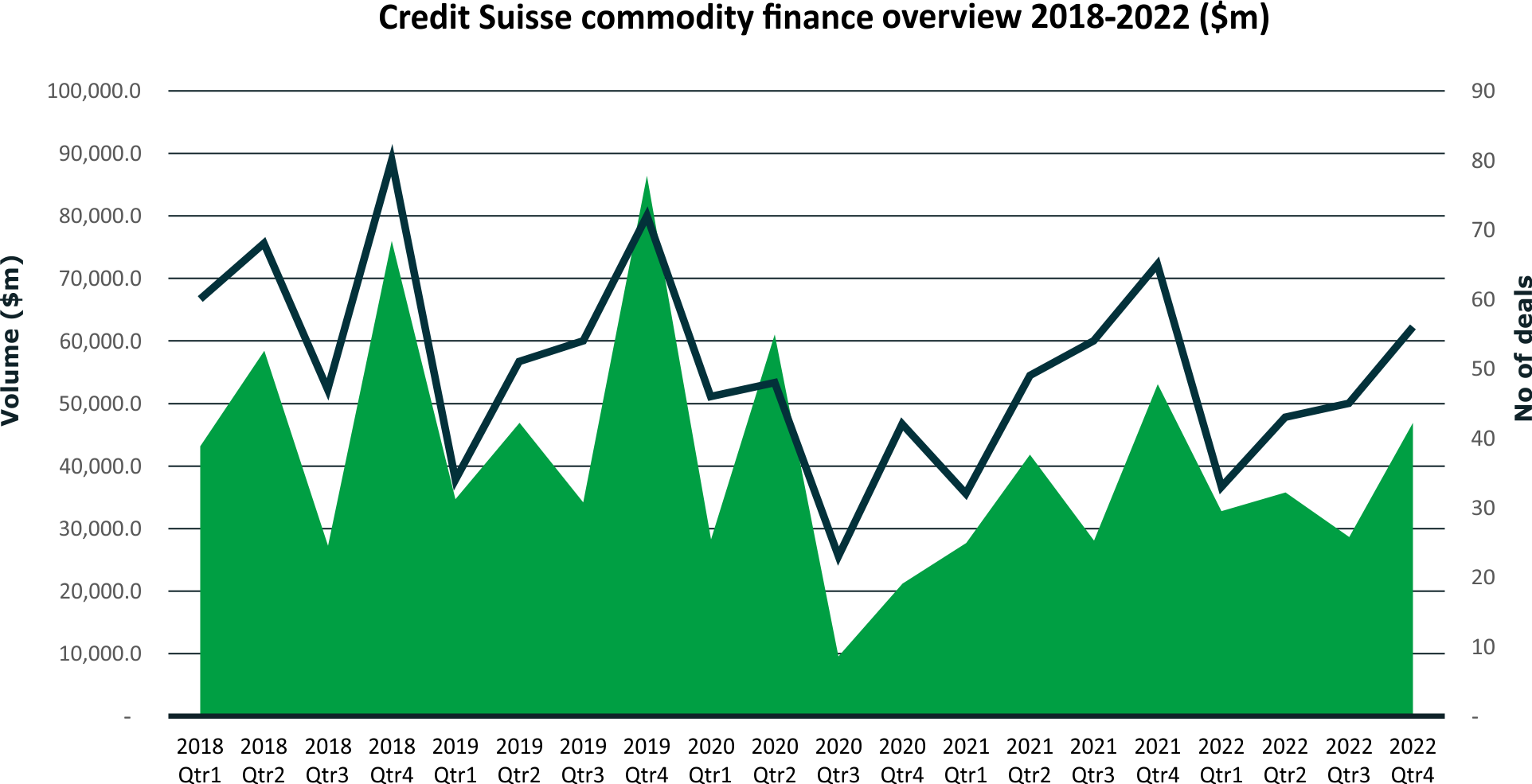

As the dust settles, it is worth taking stock of the Credit Suisse portfolio as the bank begins the process of restructuring. TXF has leveraged its database across both export finance and commodity finance to look at Credit Suisse’s activity in those markets since 2018. In both cases, Credit Suisse is a relatively small lender in terms of overall volume, but, since neither market is awash with spare liquidity, any withdrawal would have a tangible impact.

Let’s begin with export finance. Credit Suisse has participated in 30 deals since 2018, with a total volume of just over $4 billion, according to TXF Intelligence’s data. This places it 25th in the lenders league table by volume in that period, with a market share of 1.02%. It has shown little ambition to compete with the other major European banks that dominate the rankings, most notably BNP Paribas, Santander, and Societe Generale, the top three lenders.

A closer look at the deals in question reveals that more than half of Credit Suisse’s investments were in infrastructure ($1.18 billion), transport ($720 million), and oil & gas ($689 million). A large portion of the bank’s export finance volumes went towards three major projects: the 2019 Euler Hermes-backed $12.9 billion Amur gas processing plant in Russia, the 2021 UKEF-backed $2.78 billion Ankara-Izmir railway, and the 2018 SERV-backed $1.4 billion Ankara-Nigde highway. The geographical spread is broad, with four deals in Asia Pacific, five in Africa, five in Europe, and eight in Russia CIS.

In terms of tranche structure and credit type, Credit Suisse has overwhelmingly concentrated its efforts on traditional ECA-backed buyer credits, which made up more than $3.7 billion of its commitments. A handful of term loans were also recorded, as well as one DFI-backed tranche in a $1.08 billion facility for the 2021 Luanda Bita water supply project, guaranteed by Bpifrance and the International Bank for Reconstruction and Development (IBRD). The 30 deals were split evenly between project (9 deals), sovereign (10), corporate finance (11).

By comparison, UBS export finance activity is negligible, at $1.13 billion since 2018. A closer look at the figures reveals that UBS posted $893 million of this activity in 2022 alone. Of course, it would be pure conjecture at this stage to assume that UBS has been looking for opportunities to increase its export and agency business. These figures are still small fry, and there are serious questions to be answered about the assets that Credit Suisse is still exposed to, not least the Amur plant in Russia. However, if UBS wants to cultivate more business in the industry, then Credit Suisse can offer a competent project and export finance team with significant experience in the infrastructure and energy markets. In the project space, Credit Suisse was once known as something of a powerhouse, mobilising just under $50 billion in deal volume since the start of 2019.

In the commodity finance markets, Credit Suisse has established itself as a notable lender through regular participation in credit facilities for the major traders, including Glencore and Trafigura. Since 2018 the bank has lent $11.9 billion over 137 deals, giving it a ranking of 19th in terms of volume according to TXF Data. Switzerland’s status as a central hub of the commodity trade has never convinced the bank to establish a greater industry presence, but that does not mean that it lacks a valuable commodity finance product.

A well-documented lack of liquidity has dogged traders since the fraud cases of 2020. For those outside the top tier of financing, reliable sources of funding are few and far between. The threat posed by a potential withdrawal of credit was credible enough to force the CFOs of Gunvor, Mercuria, Trafigura, Vitol, and Castleton to reassure an audience at the Financial Times Commodities Global Summit that the plight of Credit Suisse would not lead to a serious squeeze on commodity finance.

The larger traders are prominent on Credit Suisse’s balance sheet. Trafigura (12 deals, $1.3 billion), Glencore (six deals, $1.1 billion), and Gunvor (17 deals, $925 million) make up the top three borrowers. It is unsurprising then to see that the bank’s most common tranche structure is the unsecured revolving credit facility. Beyond the big names, Credit Suisse has also extended funding to a broad set of mid-tier traders and producers for sums ranging from $20 million to $300 million. Those companies that find themselves in this bracket face an anxious wait to find out the long-term prospects of Credit Suisse’s trade finance department.

In terms of sector focus, oil & gas has dominated Credit Suisse’s portfolio over the past five years with 71 deals at a volume of $7.2 billion. Metals & mining (29 deals at $2.1 billion) and the agri-trade (28 deals at $1.7 billion) complete the top three.

UBS places 29th on the lender list, with 96 deals at a volume of $6.9 billion. Its decision on whether to remain in the commodity finance markets will depend on its appetite for the volatility that has characterised trading conditions in the last year. Falling commodity prices have eased financing pressures in recent months, but the future looks uncertain as oil & gas continues its exit from the centre stage. This may yet encourage UBS to retreat towards its biggest partners, even if Trafigura’s recent woes suggest that there are no truly safe bets in this industry.

Become a subscriber today for unrestricted access to the best export, trade and commodity finance analysis available.

Click here for information on the different packages available for you and your team

Exclusive subscriber-only content published last week:

TXF MENA 2023: Where ambition meets action

The 2023 TXF MENA event brought together key players in export, project, and development finance to discuss the latest trends in the market. A recent spate of big-ticket projects has made headlines, but just as important were the discussions around support for new exporters as the region diversifies. The energy transition took centre stage as delegates debated MENA’s path away from hydrocarbon wealth.....Read on here

Sullivan: Strategies for managing and preventing contractual disputes

Sullivan partner Marian Boyle provides tips to avoid getting into disputes and manage the early stages of a contractual dispute or potential dispute, as well as a reminder of some of the areas of risk that need to be effectively navigated.....Read on here

DRC-Zambia border post project out to banks

A DRC-Zambia border post project is out to the bank market, according to a source with knowledge of the matter. The project is being procured to...Read on here

Vodacom launches market sounding for telecoms financing

Vodacom has initiated a market sounding for the financing of telecoms towers and FTTH infrastructure in African countries in which it has a telecoms....Read on here

More details emerge on BII & Metito’s private-investment platform for water infra in Africa

Metito Utilities Limited (Metito) and BII recently announced the launch of their new company Africa Water Infrastructure Development (AWID), a....Read here

IFC mulls support to Congolese solar projects

The IFC is mulling over equity commitments into Congo Energy Solutions to fund 15MW of solar hybrid mini-grid projects in the Democratic Republic of....Read on here

Mirfa seawater PB chosen

ADNOC is understood to have appointed a preferred bidder for its Mirfa seawater nano-filtration oilfield scheme from the two bidders shortlisted in....Read on here

Call for Rovuma LNG FEED

The shelved Rovuma LNG project – sponsored by ExxonMobil, Eni and CNPC – is moving forward again. ExxonMobil Mocambique has issued a call....Read on here

IFC mulls BRL800m for Neoenergia’s 2023-25 capex plan

IFC is considering providing an eight-year BRL800 million ($152.6 million) green and sustainability linked loan to Elektro Redes SA...Read on here

Mongolia's Khan Bank taps debut green bond

The largest commercial bank in Mongolia — Khan Bank — tapped a 5-year $60 million green bond this month. The deal, led by IFC along with....Read on here

Unique Meghnaghat loan signed

Unique Meghnaghat Power (UMPL) – a joint venture between Unique Hotel and Resorts (51%) (UHRL); GE Capital Global Energy Investments (20%)....Read on here

Ratch refinancing of Kemerton and Townsville closed

Ratch Australia has refinanced two gas-fired power projects – Kemerton and Townsville – with around A$209 million ($149 million) of....Read on here

Bidders line up for revamped Taiba and Qassim tender

Bidders are lining up for Saudi Power Procurement Company’s (SPPC) revamped tender of the Taiba and Qassim gas-fired independent power projects....Read on here