The changing face of MENA export credit agency-backed financing

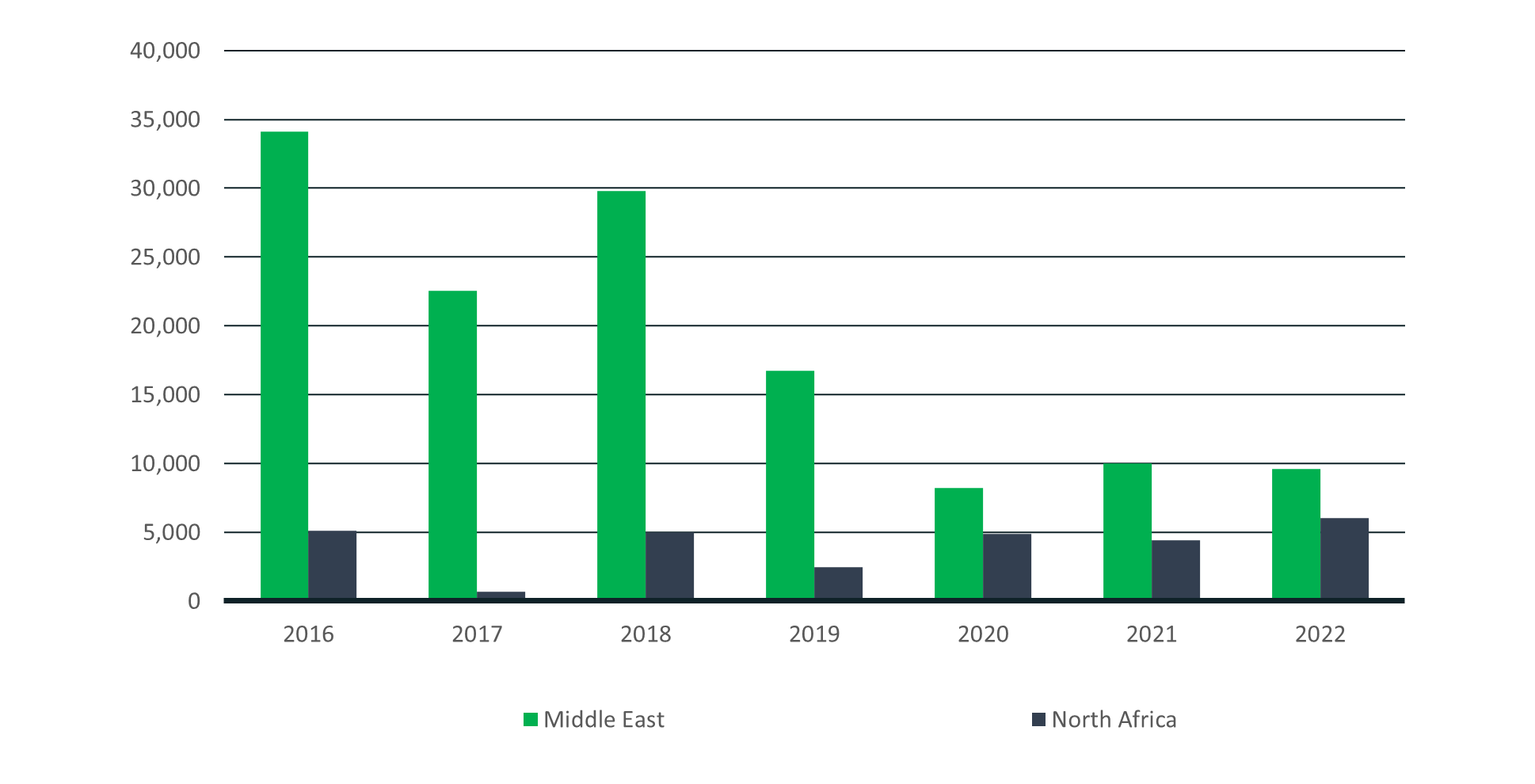

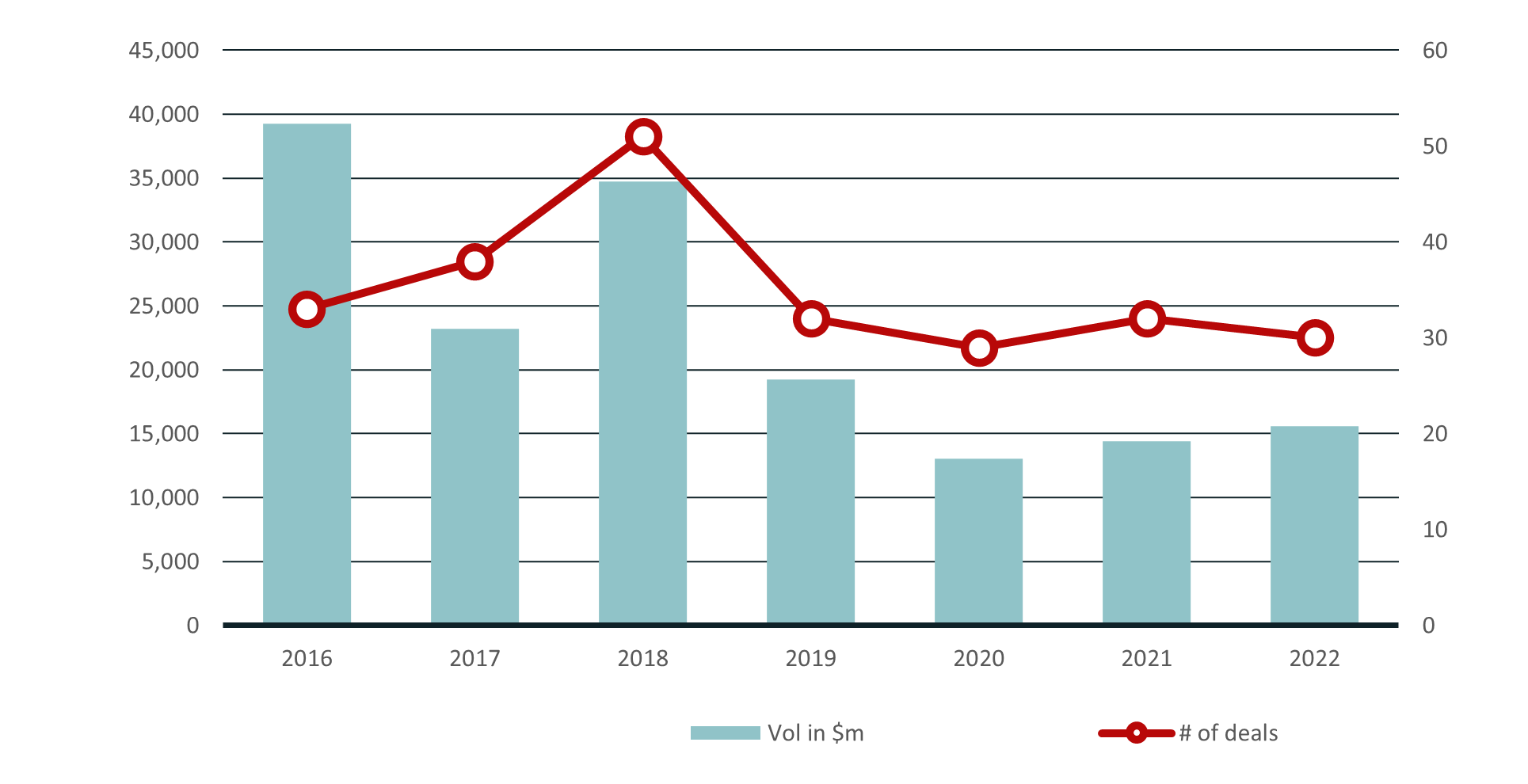

The volume of ECA business and the number of deals is down in the Middle East, but at the same time we are seeing higher volume and more deals in North Africa. Industrial diversification is driving the changes of a region in transition.

There is a significant evolution taking place in the Middle East and North African (MENA) region in terms of export credit agency (ECA)-backed export and project financing - which over the last few years has largely mirrored the changing industrial outlook and direction of much of the region. This industrial diversification trend is one that the oil & gas producing nations knew they needed to explore and ultimately embrace, and for the Gulf Cooperation Council states this is a process that has been underway for some time.

As such, the number of big hydrocarbon projects backed by ECAs had already started to dwindle. In addition, oil/gas revenues in those countries have increasingly become used in sectors such as oil/gas downstream activities, healthcare, social projects, renewable energy, high-tech and productive industries. At the same time, many of the ECAs and banks have now stopped financing new upstream oil & gas projects and are focused on supporting exports and viable projects in other sectors throughout MENA.

But interestingly, while we are seeing a reduction in overall ECA volumes in the Middle East region overall, we are also witnessing an increase in ECA business within North Africa. Consequently, we are seeing ECAs looking to support and explore opportunities in a wider range of sectors. This is very much an ECA transition zone and one that has legs to grow as new industries expand.

Confirming this trend, TXF Intelligence’s latest ‘Export finance 2022 - MENA analysis’ report states: “The MENA region reached its highest volume [of ECA-backed deals] in 2016 at $39.2 billion, but there was a notable fall starting in 2019. Since then, we have not seen volumes over $15 billion. A similar trend is observed in the number of deals, with a peak of 51 deals in 2018 and an average of 30 deals every year since then.”

TXF Intelligence added: “When breaking down the region into the Middle East (ME) and North Africa (NA), we can see that the market behaviour is quite different. Most of the fall in volume is attributable to the ME, while NA has seen growth every year since 2019. In terms of the number of deals, the difference is even more significant, with a big spike in growth in NA that is progressively replacing ME deals in the export finance market. In the 2016-2019 period, NA represented around 11% of the total MENA volume, while in the 2020-2022 period it spiked to 35%.”

The TXF Intelligence’s ‘Export finance 2022 - MENA analysis’ report also stated: “Our data shows that the self-imposed restrictions from banks and ECAs are starting to have an impact on the MENA market. As a result, the landscape by industry is changing, with more activity in manufacturing, transport, renewables, and social infrastructure, and less focus on oil & gas and petrochemicals.”

MENA region breakdown by volume

Region breakdown of # of deals

A TXF Intelligence subscription not only gives you access to more industry data like this, but also TXF's back catalogue of data and industry research reports, detailed information on closed deals and open opportunities and so much more. Get in touch with us today to find out more at intelligence@exilegroup.com.

Big deals still hit the market

Even with this changing export finance map, some big deals are still hitting the market, albeit not on such a high frequency and with a more diverse sector spread possibly than in the past.

The TXF Intelligence report notes that the biggest ECA-backed deal in the MENA region last year was the $3.9 billion ADNOC high-voltage line to connect oil pumps to the shore and reduce the carbon emissions of this process. The deal has JBIC and Kexim on board. While still in the oil & gas sector the transaction has a focus on the environment through carbon emission reduction.

Looking at transactions that were supported by ECAs in North Africa last year, one of the most significant deals in the region in 2022 was the $2.2 billion Green Line rail project in Egypt – a transaction which closed on 28 December 2022. Transportation infrastructure continues to be a key sector for development and ECA support, in this case German ECA Euler Hermes is backing primary contractor Siemens Mobility.

The Egyptian railway system is one of the largest in the MENA-region but has suffered severely due to lack of investment and maintenance, and is now marked together with water and energy, as a top priority in Egypt’s infrastructure development plans. The Railway Infrastructure Master Plan focuses on (i) improving the availability and quality of transport, (ii) enhancing transport capacity and (iii) optimising the network layout, i.e., connecting the main port, tourist attractions, capital cities and industrial areas, and developing a network of lines of 15,000km by 2030.

The main benefits will include a reduction of road traffic and associated pollution, a reduction of carbon emissions by 70% compared to the current car and bus transportation and an increase of 15% of the inland freight transport via rail. The Green Line will allow for express passenger services, regional passenger services and freight train operation. The line has a length of approximately 660km.

Also in Egypt, there were two $700 million + ECA- backed deals last year related to the expansion of the Assiut Oil Refinery. Both transactions were backed by Italy’s Sace supporting EPC contractors Technip FMC, Enppi and Petrojet. The financings support the implementation of a hydrocracker complex, which will be an essential part of Egypt’s downstream sector and production of jet fuel, diesel, kerosene and other products, much of which are currently imported.

Sticking with the expansion of ECA activity in Egypt, a $400 million transaction to support the export of Swiss equipment to the Egyptian textile sector was closed in mid-2022. Within this deal SERV is covering a loan for the Cotton, Spinning, Weaving & Garment Holding Company, for financing delivery and commissioning of spinning and weaving machinery for the modernisation by the borrower of its various plants across Egypt.

This is a particularly impressive deal for a highly important Egyptian industrial sector. The SERV cover and financing absorbs substantial complexity considering there are 87 individual supply contracts in three different currencies with deliveries to seven sites across Egypt each with individual environmental and social requirements. The state-of-the-art machinery delivered from several renowned Swiss manufacturers will substantially reduce energy consumption while also significantly increasing output and providing skilled employment opportunities across Egypt.

Full details of all the above-mentioned deals can be found within TagMyDeals, the data arm of TXF Intelligence.

Positive industrial expansion for the road ahead

The changing face of industrial diversification in the region can be seen in some very recently announced planned industrial investments – which provides a small indicator as to the direction of development. At the weekend at the Higher Committee Meeting of the Industrial Partnership for sustainable Economic Development in Jordan some $2 billion worth of agreements were signed - within chemicals, healthcare, automotives and minerals. Whilst not involving ECA support at this stage, such developments are an indication of where industrial investment is increasingly taking pace in the region.

Examples of these include an investment of $400 million by UAE’s CFC Group to establish an industrial complex for fertilisers and chemicals in Egypt; UAE’s M Glory Holding investing $550 million to set up three electric vehicle plants with assembly lines in the UAE, Jordan and Egypt; Emirates Global Aluminium with $200 million for a silicon metal plant in the UAE; and, Egypt’s Soda Chemicals Industry with $500 million to invest in a plant to produce sodium carbonate.

It is entirely possible that with such deals and other developments, where there is out of country investment, we will see further involvement of the UAE’s export credit agency Etihad Credit Insurance (ECI) in projects supporting UAE companies. Similarly, the recently established Saudi Exim Bank has the design to promote the development and diversification of Saudi exports.

While in another recent development in Morocco, two weeks ago UK company Emmerson appointed an initial syndicate of banks as mandated lead arrangers (MLAs) to coordinate and fund dual-tranche debt financing facilities for the development of the Khemisset potash project in Morocco. The four MLAs are ING Bank, Banque Centrale Populaire, Bank of Africa and one other un-named international European Bank.

The $310 million dual-tranche financing will be split between an ECA-covered tranche led by UKEF of $230 million, and a dual currency commercial tranche of $80 million. Sender International and Colosseum Development are advising Emmerson on the debt financing of the project, working alongside Tamesis Partners as the company's financial adviser for the financing of the project.

Become a subscriber today for unrestricted access to the best export, trade and commodity finance analysis available.

Click here for information on the different packages available for you and your team

Exclusive subscriber-only content published last week:

Export finance 2022: A new energy security role for ECAs

Political instability is usually one of the key drivers of the use of ECA support in emerging markets. In developed markets ECAs are usually used to drive down pricing, drive up tenors, and sometimes compensate for losses of liquidity... Read on here

What 2022’s export finance volumes say about its unsettled politics

When poring over the data for borrower location in TXF Intelligence’s Full Year 2022 export finance report it is important not to confuse correlation and causation. But some connections are just too tempting to ignore... Read on here

A sneak peek: Commodity Finance Data Report 2022

Ahead of the release of The Commodity Finance Data Report 2022 to TXF subscribers we take a first look at some of the top takeaways... Read on here

Despite oil & gas declines, 2022 export finance volumes hold up

TXF Intelligence's 2022 export finance data report is here. Read some of the key takeaways from the full-year report... Read on here

Sullivan: The anatomy of non-payment insurance policies

Sullivan partner Marian Boyle, partner at law firm Sullivan, covers the main clauses found in comprehensive non-payment insurance policies and provides practical advice for policyholders on the drafting and operation of these key credit support instruments... Read on here

Tanah Laut onshore wind IPP progresses financing

Sponsors of the 70MW Tanah Laut onshore wind IPP in Indonesia — Adaro Energy and Total Eren — are progressing with the approximately $200 million DFI-backed debt package to fund the project... Read on here

AIIB extends loan to Indian solar firm

AIIB has approved a non-sovereign loan to support the development and operation of a portfolio of distributed solar projects by Indian firm Fourth Partner Energy... Read on here

ADB tenders EOI for solar-grid pilot project

ADB has tendered an EOI for consultancy services for the Developing Solar Systems at Scale project... Read on here

AIIB, IBRD mulls additional $450m for Jordan investment scheme

AIIB and IBRD are considering additional co-financing of $450 million for Jordan's Inclusive, Transparent and Climate Responsive Investments Programme... Read on here