ECAs: Behind the methodology of sustainability

There is a need for collective definitions and methodologies to better interpret the multitude of existing sustainable frameworks to apply within export finance. TXF Intelligence's Sustainability in Export Finance report collated deal flow from the past five years and applied its own set of ESG metrics to ratify our data.

Given the raft of different metrics to measure sustainability and the Sustainable Development Goals (SDGs) – equator principles; LMA’s green and social loans; TCFDs and ICMA green bond principles – it is clear one size does not fit all.

But at the very least – within the export finance product offering specifically, where sustainable deal flow has ballooned in recent years – there is a need for collective terminologies and definitions within the different frameworks applicable to sustainable export finance transactions.

The ICC Global Export Finance Committee’s Sustainability Working Group – comprising 16 of the most active ECA banks (including a handful of global heads) and the Rockefeller Foundation – has helped to clarify the interpretation of these different frameworks by garnering collaborative feedback from ECA-backed dealmakers and relaying that back to key industry stakeholder.

And here at TXF Intelligence, we have collated our existing export finance data (over the past five years) and applied existing methodologies – such as ICMA’s green bond framework – to help classify transactions as green, social or sustainable, with information largely driven by the information provided by deal participants.

As the data available for such a market sizing exercise is self-submitted by market participants, the choice of classification methodology was largely driven by the need to drive a common approach across the ECA industry.

A large number of arranging banks active in the ECA market are already green bond issuers and, in some cases, social and sustainability bonds issuers. In addition, ECAs such as EDC and the Exim-Import Bank of Korea (KEXIM) are also green bond issuers. As issuers, these institutions have in place the expertise and governance mechanisms to classify ECA transactions as green, social or sustainable in line with the principles and guidelines. Likewise, it is hoped that as more ECA assets are earmarked against green, social or sustainable bonds, it will encourage institutions to increase sustainable bond issuance, thus creating a virtuous cycle which will increase the size of sustainable debt capital markets.

The Sustainability League Tables have been developed using a methodology which is consistent with market practice in the Sustainable Finance universe. We believe this approach will help harmonize sustainability classifications across various sustainability products/markets within banking and finance.

Renewables: Green by definition

Renewable energy projects are clearly green by definition, both solar and wind farms generate green energy and are not carbon-intensive to operate, unless someone decides to strap a solar panel to a humpback whale. However, other more obvious brown sectors are not so clear cut.

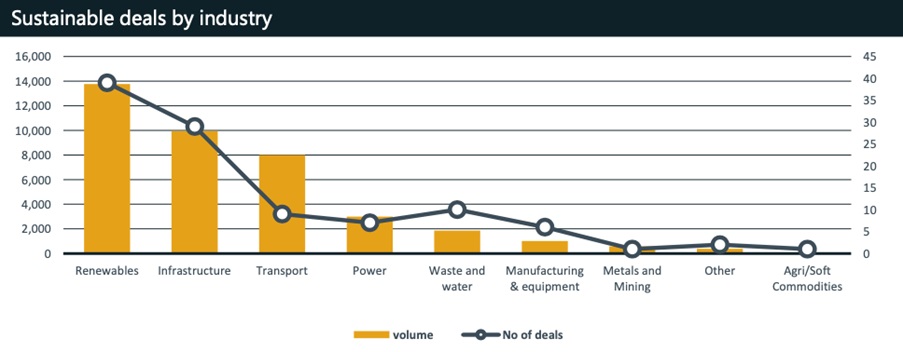

It is not surprising that renewables was the source of the greatest volume of sustainable deals in 2021, according to TXF Intelligence’s Sustainability in Export Finance Report.

Decarbonising electricity generation has been a multi-decade process, and is now a popular segment for investors. Infrastructure – including roads, rail, transit and social infrastructure – also performed strongly. But if transport and power – which urgently need to decarbonise – are now producing sustainable deals the outlook for the transition is promising.

Drilling down into power and renewables

Nothing illustrates offshore wind’s dominance of export finance volumes better that considering its share of the power and renewables market. It accounted for a little under half of all of the sector’s volumes (see infographic above), thanks to just seven transactions.

This dominance is unsurprising. Offshore projects are capital intensive, require complex supply chains, and rely on a manufacturing sector that governments are anxious to support.

Perhaps more surprising is that onshore wind produced lower volumes than solar, given that it is much easier to line up ECA support for turbine exports than panel exports, though transaction numbers were far ahead of other assets.

Equally concerning however, may be the low volumes for electricity transmission and battery storage technologies. These are assets that are vital to the energy transition, and generally sources of good manufacturing jobs. Those numbers can – and should – increase, and batteries are at least a relatively young industry.

According to banks that took part in TXF Intelligence’s Export Finance Research report 2022, renewable energy looks set to garner the largest amount of capital allocation over the next 12 months: with survey data revealing almost all ECAs support renewables with 73% expecting to increase their support in 2022, and this trend has been compounded by the stronger focus on energy transition from policymakers, lenders, project sponsors and ECAs in the wake of the pandemic and Russia’s invasion of Ukraine.

In short, ECAs will look to increase support for renewables to diversify the energy mix of their respective countries, so in turn expect the ECAs from countries reliant on Russian energy – Germany and Italy for example – to be particularly active in this sector over the coming years.

With over 400 unique survey responses from 29 individual banks, 18 ECAs and hundreds of their corporate clients (and insights from multiple interviewees), TXF Intelligence's Export Finance Research Report 2022 oscillates from analysing our data on ECA/bank exposures within the Russia CIS region to the lumpy capital allocation expected for renewables going forward.

Infra & waste and water

It will be a source of pride for the export finance community that its leading contributions to infrastructure development are in water treatment and healthcare. These are the sectors that make the greatest contributions to human well-being. Water has the additional benefit of supporting high value exports.

If water treatment and sewage networks are counted together the sector’s leadership is even more pronounced. Big-ticket projects in Ghana, Angola and Cote d’Ivoire drove these volumes. As noted above, governments were the borrowers under these transactions, unlike renewables, where private developers dominate.

This pattern continued for roads and rail, with government borrowers also dominating. The only exceptions here were Ecuador’s Yilport, a private port operator, and the concession for line 2 of Lima’s Metro, which raised a second SACE-covered tranche of financing.

Transport

Four borrowers – Hapag Lloyd, Seaspan, British Airways and Jaguar Land Rover – were responsible for the bulk of sustainable export finance deals in transport.

And British Airways on its own accounted for half. Its UKEF-supported COVID-19 relief loan did just about count as sustainable, given its energy efficiency features. But the aviation sector in general, whatever its difficulties under COVID, will struggle in general to make a sustainable case, unless investment leads to meaningful improvements in its carbon footprint.

There are probably more opportunities in the automotive and shipping sectors to support the manufacture of low-carbon equipment, whether ships that run on LNG or electric vehicles.

Rail did not experience a strong 2021 even though its carbon benefits are likely to be higher than ever. The strongest explanation for this was probably the poor financial health of the major rail and transit operators – at least in the passenger sectors – as workers stayed home en masse in the developed world.

If you are a TXF Data subscriber and want to download the full 19-page TXF Intelligence Sustainability in export finance report 2021 please click here

If you would like to request a TXF Data demo please click here

Exclusive subscriber-only content published last week;

Sustainability in export finance report 2021

TXF Intelligence’s third sustainability in export finance report makes clear what export finance professionals active in the market already know. Sustainability is moving towards the centre of the industry’s business model....Read on here

Under the radar: Electricity transmission in Pakistan

FMO and Proparco’s seven-year loan to Pakistani electricity provider K-Electric to finance the upgrade of its transmission system is arguably the replicable bankable long-term structure that the sector has been waiting for.....Read on here

Rovuma LNG deal negotiations to restart this year

The $17 billion Rovuma LNG project financing is expected to restart negotiations with lenders and ECAs this year, according to a banker close to the deal.....Read on here

Gerald Group appoints new global head of structured trade finance

Gerald Group, the world's largest independent, employee-owned metal trading house, and one of the world's leading global commodity trading companies, has appointed....Read on here

Energy blackmail and the erosion of trust in Russian commercial contracts

The decision taken by President Putin of Russia to tell Gazprom on 27 April to stop sending gas to Bulgaria and Poland has been described as....Read on here

SMBC appoints new co-head for Asia-Pacific structured finance

Sumitomo Mitsui Banking Corporation (SMBC) has appointed Tomofumi Watanabe as managing director and co-general manager of the Structured Finance Department in its Asia-Pacific division...Read on here

Azzam takes on role at Saudi EXIM

Mohamed Azzam, formerly managing director of Export Credit Guarantee of Egypt (EGE), has joined Saudi EXIM Bank as executive advisor...Read on here

Barka IWP ECA-backed financing progresses

The ECA-covered debt backing GS Inima’s Barka independent water project in Oman is progressing...Read on here

AIIB approves loan to Uzbek water supply and sanitation project

On 13 April, Asian Infrastructure Investment Bank (AIIB) approved a $248.4 million sovereign loan for the....Read on here

More details on Netcity fibre refinancing

Further information has emerged regarding the refinancing of the Netcity fibre network in Bucharest, Romania....Read on here

ADB issues RFPs to climate-related investment advisers

On 25 April, the ADB issued RFPs to four prospective advisers to conduct studies for addressing the....Read on here

Sun returns to ICBC

After a four-year stint at China Merchants Bank in New York, Allan Sun has returned to ICBC as head of project finance in the Americas....Read on here

ADB approves non-sovereign loan for Indian solar PV

ADB has approved a Rs4.063 billion ($53.8 million) loan with....Read on here

More details on Gemini Solar + Storage financing

More details have emerged on the very recently closed debt financing of Quinbrook portfolio company...Read on here

IFC invites advisory bids for West Bank solar IPP

The IFC has invited expressions of interest for the technical advisory services on a 9MW solar farm in the West Bank.....Read on here

ChemOne's PEC project out to banks next month

Singapore’s ChemOne Group is expected to launch the financing to commercial banks for its.....Read on here

DIF closes on Polish wind portfolio financing

DIF Capital Partners has closed on debt financing for the construction of a 108MW portfolio of onshore wind farms in Poland.....Read on here

Zenobe closes financing for New Zealand e-bus project

Zenobe Energy has reached financial close on a NZD50 million ($32.7 million) non-recourse financing for an.....Read on here

Innergex signs debt for Hale Kuawehi Solar BESS project

In mid-March, Innergex Renewable Energy signed the debt facilities backing its Hale Kuawehi Solar Project – a 30MW...Read on here

Malla Vial de Meta 4G road construction debt closed

Grupo Argos-owned Odinsa has reached financial close on a COP590 billion ($148 million) loan to facilitate.....Read on here