Lowering the toll: The next step in the digital trade evolution

Why are there still so few bridges between digital islands? And no ‘cars’ on the bridges that have been built? Michael Vrontamitis, advisor at Kountable and Subra Shankhar, founder and principal at TOTTA look at why digital islands persist, and how they can be bridged. Do not ignore smaller businesses.

As digital trade nerds, the last few years have been exhilarating. Back in 2017 there was no plan, no common understanding of what was actually required to digitise trade, and everyone was trying to understand the ‘B’ word [blockchain]. At that time the International Chamber of Commerce (ICC) Trade Finance Digitisation working group published the ICC Digital Trade Roadmap[1] laying out what was required for some of the key actors to solve for the digital island problem that is exponentially growing in trade and trade finance.

The roadmap created this common understanding and laid out three pillars.

- Government focused on updating legal infrastructure through implementing commitments, reviewing laws, identifying, and removing barriers and aligning to international best practice.

- The ICC focused on rules and standards through building consensus, aligning resources, and connecting initiatives.

- Industry focused on digital transformation through upskilling teams, digitising processes, integrating systems and piloting innovative technology solutions

In July 2021 BAFT and ITFA published a paper[2] prepared by the ICC Trade Finance Digitisation working group that demonstrated tremendous progress being made. For example, the need for harmonisation of country’s domestic legal frameworks with UNCITRAL’s MLETR[3] is now on the G7 agenda with progress being made in numerous jurisdictions. The ICC launched the ICC Digital Standards Initiative [DSI]. New eRules were released – eUCP2.0, eURC1.0, URDTT1.0. There were also BAFT’s Distributed Ledger Payment Commitment (DLPC) and ITFA’s ‘Manual of Digital Negotiable Instruments,’ among others at a speed more reflective of the digital era versus the multi-year processes that had been followed in the past for new rule sets.

In 2017 the only people who understood MLETR and its potential impact were sitting in the back of the room in their proverbial white coats. Today, even politicians understand the importance of having it on their agenda. That’s how far we’ve come. There are dedicated people all over the globe, lobbying, reviewing, and implementing many of the recommendations in the first two pillars of the roadmap.

The question therefore is why after all this effort are those increasing number of digital islands still not connected? When the islands are connected, why is the use of them still so low?

Still early days

The simple answer here is that it is still early days. We are still at the starting line. Early versions of rules have been written, standards published and connected, while laws to enable the digitisation of trade are newly published, in flight or being discussed. As with every big transformation project once you are sure that you have the rules, laws and standards in place you need to design and build solutions. And this is where we are.

Pillar three of the ICC Digital Trade roadmap calls for industry to undergo a digital transformation. To prepare systems, integrate them, upskill workers. All great words, but what does it mean in practice?

Typically, when a large enterprise digitises a process well, they review their own workflow, identify process improvements, and develop the requirements for an automation solution. It is rare for any large enterprise to look beyond the process within their own company for example their suppliers’ or (business) buyers’ processes. Once the requirements are finalised the large enterprise will issue an RFP, select a technology vendor, and then implement.

To ensure success of the solution, their partners will need to adopt it. Large enterprises generally use their market power to force adoption. Small businesses may not have a choice if they want to continue to do business with their large buyer or supplier.

In implementing the large enterprises’ solution, the small business will usually need to update and receive data through a web portal if they don’t have the ability to integrate into their own workflow digitally.

Equal sized counterparties or co-dependent ones to the large enterprise may agree a direct integration via API, EDIFACT or some other standard communication and messaging protocol in order to fit into their own workflow and while there are costs involved in this integration it is necessary for success.

The large enterprise here has digitised its process, but its ecosystem is far from digital. In a connected system you can’t just digitise part of the system for it to be digital. Each of these solutions therefore becomes its own digital island.

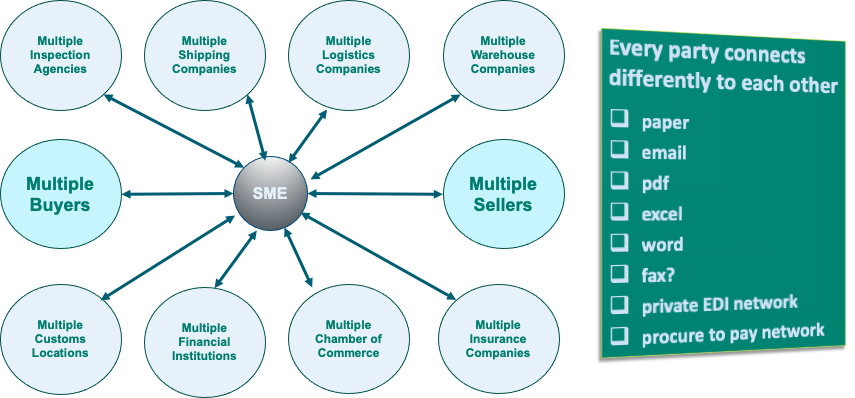

So how does this feel as the small business who is being asked by its big suppliers and buyers to connect to them in their preferred manner, let alone a myriad of service providers and government agencies with multiple ‘Single Window’ programmes that have their own connection preferences?

How does it feel to be the small business?

The complexity of this is the toll that is required to digitise each bridge. Given the resource constraints and prioritisation on income generation most small businesses don’t generally have the capacity to solve this problem irrespective of the scaling benefits solving it will give them because the cost and understanding required to solve it in the first place.

While protocols to interface two systems are readily available, the real cost of connecting is in defining datasets, agreeing liability clauses and legal negotiation. As a result, most small businesses involved in international trade naturally default to paper in their core processes with haphazard digitisation depending on what their trading partners demand.

This complexity is the toll that is stopping cars from using the bridges.

What is needed to lower the toll?

This is not an easy question to answer. It is less about the toll and more about redesigning the bridges. Very few people are actively solving this problem for small businesses. The focus is on solving the automation challenge for large companies and government.

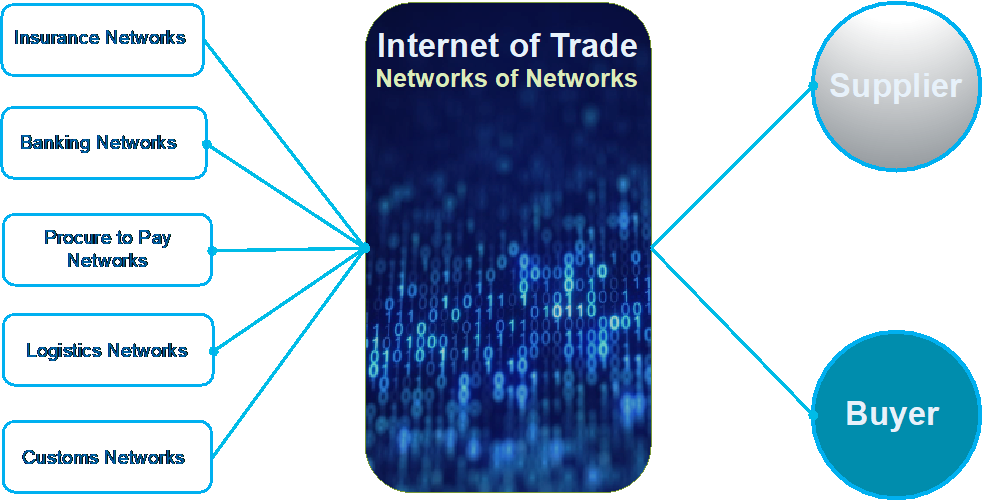

Small businesses need a gateway, a connector to many platforms that enables them to scale. Building the connections to each procure to pay network, each government single window, every ERP (Enterprise Resource Planning) platform, each bank, each logistics company, insurance company and customs network.

Is the solution a network of networks?

The network of networks is about creating this interconnectivity. Is it a neutral entity providing this service? Is it a series of networks in each trade vertical connecting via a host of applications creating an ‘Internet of Trade’? Time will tell. Given the fragmentation of the counterparties in trade and its inherent complexity we don’t believe there will be one network to rule them all and collaboration is the only real viable path.

Irrespective of how the market develops, companies will hopefully see the problem that is there due to the digital islands they have helped create. New laws, rules and standards will provide a framework to enable this to be solved more holistically for small businesses.

There is an opportunity here for technology companies and industry players to leverage this evolving framework and for large enterprises to think beyond their own island and more actively engage in building bridges with no tolls. Meanwhile, small businesses will need access to unbiased information and advice on how to best to streamline their own processes and connect to their ecosystem in a way that allows them to scale in simple cost-effective ways.

[2] Progress on Trade Digitization 2021 (URL: https://bit.ly/3um8Zzm or https://bit.ly/3mc82ps)

[3] UNCITRAL Model Law on Electronic Transferable Records (2017) (URL: rb.gy/n3qlq4)