Agricultural Investment Funds target Africa

The number of Agricultural Investment Funds (AIFs) has increased significantly over the past decade, alongside an increase in the world’s population and food demand. Africa has been the chief beneficiary of this trajectory with 40% of AIFs established having an African geographic focus.

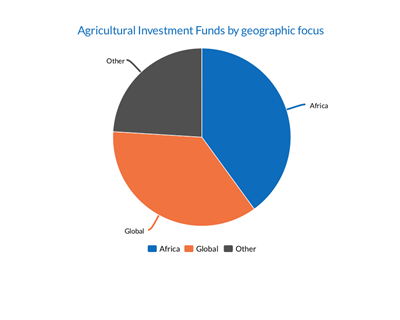

The number of Agricultural Investment Funds (AIFs) has increased significantly over the past decade, alongside an increase in the world’s population and food demand. Africa has been the chief beneficiary of this trajectory with 40% of AIFs established having an African geographic focus, according to Calvin Miller, senior officer and leader – Agribusiness and Finance Group, Food and Agriculture Organization of the UN (FAO).

Of the remaining 60%, 36% have a global focus and just under a quarter are spread across the remainder of the world.

The stark figures demonstrate the extent to which African agriculture has managed to attract investment, in spite of a still high-risk perception. There are a number of reasons for this, including the promise of strong returns on investment, greater risk-sharing mechanisms and deeper involvement of government and development agencies in a sector that is critical to Africa’s prosperity.

The global financial crisis was also a catalyst for greater AIF growth as investors looked to diversify their portfolios. Their greater involvement led the way for increased public-private collaboration, as funds offer opportunities for private sector players to share risks and enhance engagements with the public sector. Such partnerships are often arranged with a double or triple bottom line incorporated into the formal documentations, often with a view to alleviating social issues.

Alongside this quantitative rise, there has been a qualitative shift in the offering of AIFs. Funds have placed a greater focus on ‘impact investing’, such as Incofin Investment Management, which looks to invest in companies that promote “financial inclusion” while generating a positive “developmental impact and attractive return for investors,” says Gilles Vercammen, its business development manager.

One of the ways in which Incofin attempts to do this is through the provision of technical assistance to businesses that it finances, as part of its flagship Rural Impulse Fund.

Root Capital’s director of lending, Fred Kiteng’e, agrees with the importance of providing investees with technical – as well as financial – assistance. “Farmers and SMEs struggle with financial management and reporting - not just access to finance,” says Kiteng’e.

“Challenges include being unable to fully understand financial statements or prepare cash flow projections, so we help them with that,” he adds.

Root offers this help through its centralised, regional training workshops – on topics such as cash flow planning and guides to various documentations – and personalised one-to-one sessions.

Even after the training has been offered, Root continues to monitor the client and is prepared to step in when necessary.

In line with developments in the sector, the FAO has published a provisional set of Principles for Responsible Agricultural Investments. They reflect a move towards a more sustainable blueprint for AIFs – and the trends in the industry suggest that it is one that many already appear keen to take up.