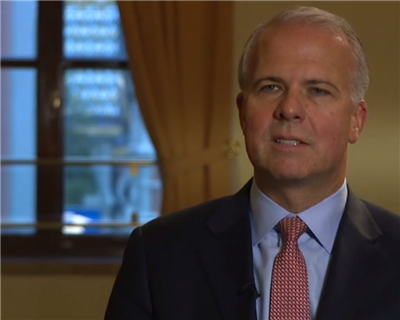

Zurich’s Daniel Riordan named Berne Union president

Daniel Riordan, CEO of Global Corporate, Zurich North America has been elected president of the Berne Union – the international association of export credit insurers. He is the first representative of a private insurer to be elected president in 30 years.

Daniel Riordan, CEO of Global Corporate, ~Zurich^ North America has been elected president of the Berne Union – the international association of export credit insurers. He is the first representative of a private insurer to be elected president in 30 years.

The election took place as part of the Berne Union annual general meeting in Vienna last week.

TXF were fortunate enough to be able to attend part of the meeting, and conducted video interviews with Daniel Riordan, as well as outgoing president Johan Schrijver of Atradius, and Rudolf Scholten, co-chairman of ‘host ECA’ OeKB.

View the videos:

- Johan Schrijver, Atradius managing director and outgoing Berne Union president

- Daniel Riordan, CEO of Zurich Corporate North America

- Rudolf Scholten, Co-Chairman at OeKB, the Austrian export credit agency

The other appointments include:

Andreas Klasen, partner and head of economics and policy of ~PwC^ (Germany), who was elected as the incoming vice president of the Berne Union.

Ralph Lai, ~HKEC^ (Hong Kong) and Khemais El-Gazzah, ~ICIEC^ (a multilateral institution based in Saudi Arabia) were re-elected as the chair and vice chair of the Short Term Committee.

Karin Apelman, ~EKN^ (Sweden) and Jing Fenglei, ~SINOSURE^ (China) were elected as incoming chair and vice chair of the Medium/Long Term Committee.

John Hegeman, ~AIG^ (USA) and Vinco David, ~ATRADIUS^ (the Netherlands) were re-elected as the chair and vice chair of the Investment Insurance Committee.

With the insurance capacity offered, Berne Union members are confident to support the same volumes of export trade and investment as last year. In 2012, they insured $1.8 trillion of international trade and investments, supporting more than 10% of world exports.

For insurance of short term trade transactions with payment terms of typically 30 to 90 days, credit insurance capacity remains steady at just over $1 trillion at the end of the first half 2013, a level higher than pre-crisis.

During the same period, growth has been flat in the field of insurance for export transactions on longer payment terms of up to 15 years. However, the volume of covered transactions remains at its highest level ever, with a total amount of $626 billion in the books of Berne Union ECAs at the end of the second quarter.

For insurance of foreign direct investment, the new business insured reached $54 billion in the first half of 2013, consistent with the same period last year.

Since the global financial crisis in 2008, members have indemnified approximately $22 billion to exporters and investors.