Export finance H1 2023: A rising tide lifts all boats

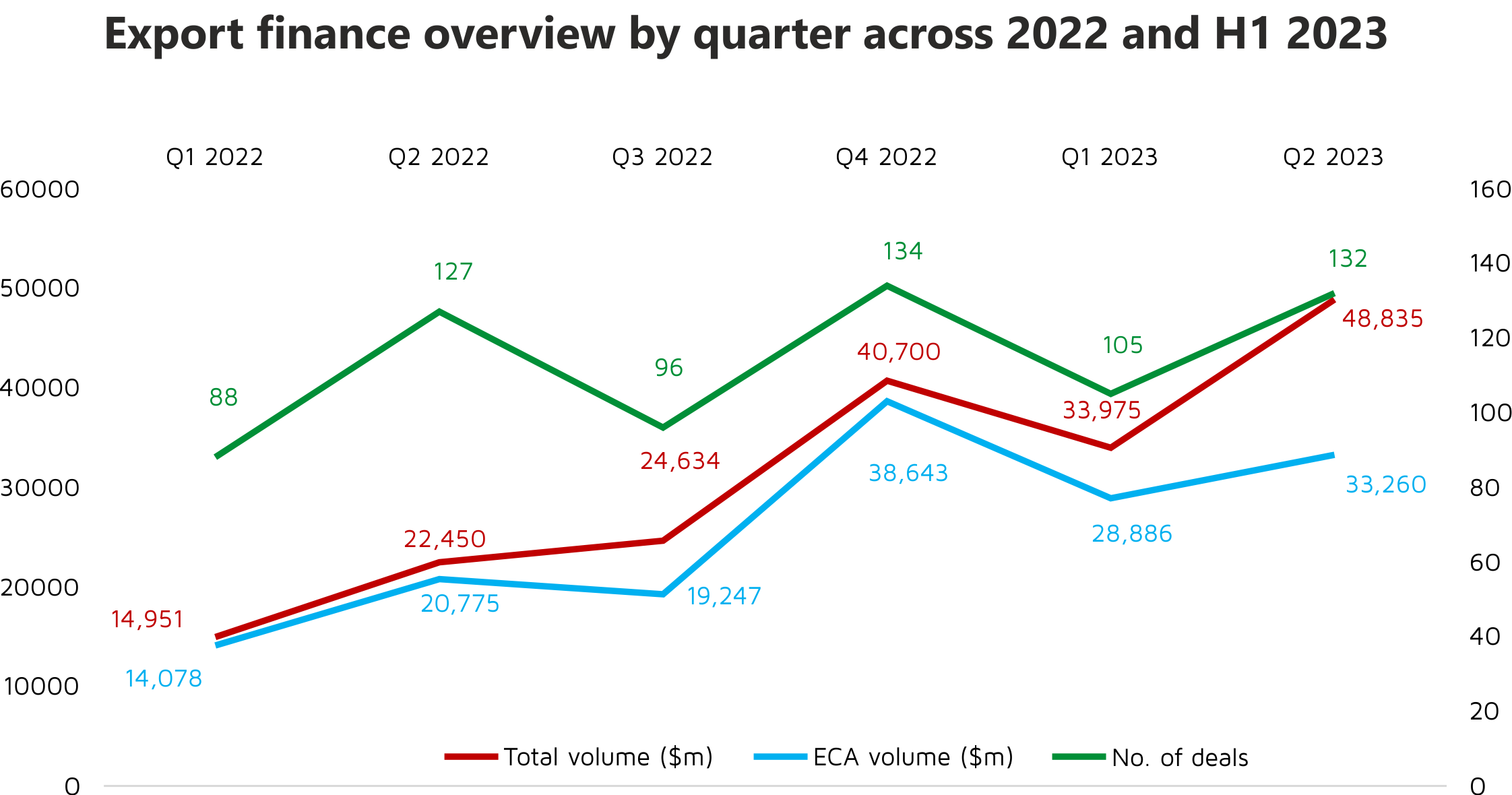

TXF Intelligence has published its market overview for export finance across the first six months of 2023. The story is simple: export finance is well-set for a spectacular year after a surge in deal activity.

TXF Intelligence has officially published its H1 2023 Export Finance market overview. The full data report is now available for subscribers to TXF Intelligence through this link.

The story in the first six months is simple – ECA-backed volumes are up, significantly up in some sectors, so much so that overlooked ECA relationship bankers in the aviation teams of large commercial lenders are, for the first time in a very long time, likely to be the life and soul of the office party this year.

Even the shipping teams, which became much less busy during and after the pandemic, have reason for optimism. The market has been so strong that in many cases it will make more sense to compare activity just for the first half of 2023 with activity over all of 2022.

ECA-backed volumes in the first half of 2023 jumped to $82.8 billion – just $10 billion less than the whole of 2022. There are signs of less concentration in the market. The top four borrower countries – Indonesia, Italy, Saudi Arabia and France – accounted for 31% of volumes, down from 40% for the top four in H1 2022.

Strong borrowing activity in Belgium, the UK, Italy and France kept Europe in the number one spot by region, with $32.2 billion in volumes and a 38.8% share of market volume. Those numbers are very similar for the entirety of 2022 in Europe, an indication that volume is likely to hit a new high by the end of this year.

Renewables ECA-backed volume has jumped from around $3 billion in H1 2022 to $11.7 billion in H1 2023 – or double the just over $5 billion in H1 2020. Conventional power is also back at a similar volume level ($11.6 billion in H1 2023), which is a first since full-year 2019 when both sectors produced equivalent volumes, although those volumes were only just over $1 billion each. Oil and gas ECA-backed volume in H1 2023 has almost doubled from the previous half year to $9.3 billion.

Aviation volume has jumped to $8.2 billion in H1 2023 – only $1 billion less than 2020-2022 volumes combined. ECA-backed shipping volume has climbed to $6.3 billion, up from $5 billion in H1 2022. Non-cruise volumes are roughly back to where they were for full year 2019 – so they may surpass that year by end of 2023. And cruise business – at just over $4 billion – is around half of what it was in the same full year, so it may also yet match 2019 by the end of the year.

Almost all ECA-backed telecoms financing activity in H1 2023 backed cellular/mobile equipment orders. Only one broadband/cable deal – a small Sinosure-covered deal for Xtrim TV Cable – features in the mix, and there were no satellite deals.

The story so far this year looks like a rising tide lifting all boats, and augurs well for TXF’s full-year 2023 figures. If these trends are replicated over the full calendar year, 2023 will mark a historic recovery for the export finance industry from years of geopolitical, economic and social turmoil.

As ever, TXF’s Intelligence team welcomes your comments and feedback on the report.