Commodity finance H1 2023: A stagnant market

TXF has officially released its commodity finance data for the first half of 2023. The data reflects a stagnant market, with depressed volumes and reduced activity across all regions.

On the current evidence, 2023 will not go down as a vintage year for commodity trade finance. TXF Intelligence’s H1 2023 Commodity Finance Data Report has arrived, and the numbers reveal a sharp nosedive in activity that should raise questions about the long-term health of the industry. The full report is available for subscribers to TXF Intelligence through this link.

The headline figures are stark: TXF has recorded just 53 deals, down from 77 in H1 2022. Total volumes at the time of writing sit at $58.3 billion, a notable decrease on last year, when volumes reached $69.3 billion.

Commodity traders of all sizes have faced new challenges in the wake of the COVID-19 pandemic and the war in Ukraine, and it was no surprise to see depressed trade finance volumes for the period 2020-2022. Volatile commodity prices created huge profits for many trading houses, but exposure to high margin calls left many by the wayside, with SMEs in particular struggling to access bank credit for their trades.

The emergence of new fraud cases in 2023 has further impacted liquidity in the market. It was just a few years ago that two high-profile commodity finance banks permanently withdrew from the industry after a number of trading scandals in Asia-Pacific in 2020. In addition, Russia’s violence in Ukraine has effectively removed two major producer countries from global supply chains, reducing appetite for commodity finance.

Yet in the absence of another major black swan event in 2023 so far, some signs of progress would have offered welcome respite. While other financial sectors continue their post-COVID recovery (TXF Intelligence’s H1 2023 Export Finance Data Report reveals that volumes are at their highest for five years), commodity finance languishes.

This data comes with the caveat that it does not and cannot cover every commodity finance deal from H1 2023, since banks prefer to keep their bilateral activity with clients private. However, it still offers an insightful barometer for the health of the industry in relation to previous years.

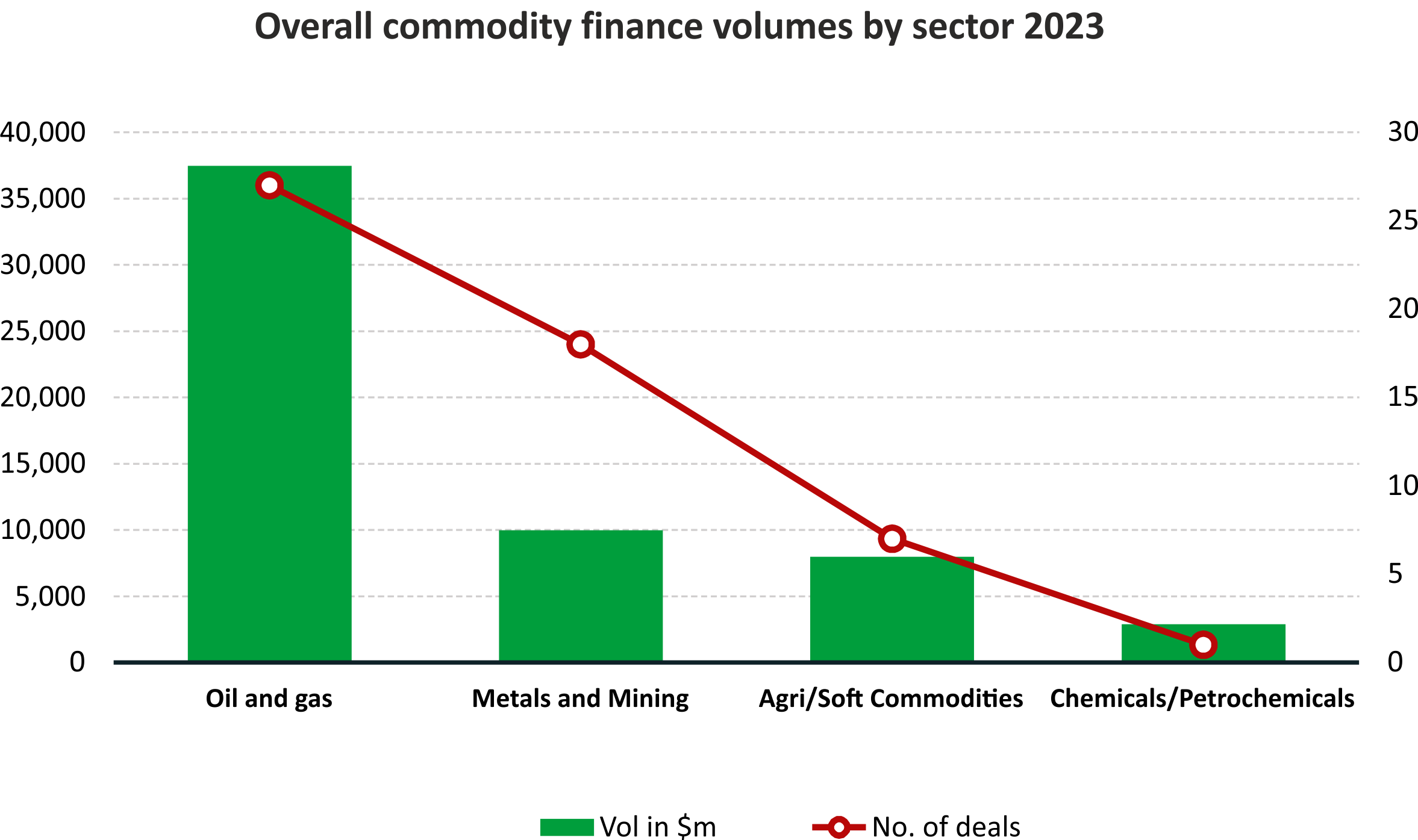

Oil & gas has returned to its perch as the largest sector after being dethroned by metals and mining in H1 2022. $37.5 billion across 27 deals represents a recovery on H1 2022, when it secured just $17 billion of activity. The scramble to secure energy supplies in the west has gone some way to restoring the viability of oil & gas projects, even if the long-term trend is still downwards. It should be noted that oil & gas declined by $28.6 billion between H1 2021 and H1 2022.

The mining industry seemed to make its long-heralded breakthrough in 2022. If the energy transition must rely upon battery technology, then the supply of metals to power those batteries should increase exponentially in the coming years to feed demand. However, investment continues to fall behind those predictions. $10.0 billion across 18 commodity finance deals represents a major decrease in volume year on year, even if the number of deals suggests that a healthy number of players are active in the market.

Soft commodities recorded $8.0 billion across seven deals. The majority of this was accounted for by Viterra’s annual sustainability linked RCF. At $4.11 billion it represents almost half of the sector’s figures so far. Even with this deal in mind, roughly $4 billion spread across six deals suggests that the agri-trade is increasingly dominated by a handful of operators. News of Viterra’s merger with Bunge will entrench this phenomenon.

In terms of geography, Europe has maintained a comfortable lead over North America in terms of volumes. At almost $28 billion, Europe has maintained its lead as the world's preeminent hub of commodity finance. North America has climbed to second, but this can be attributed to declines elsewhere since volumes have remained static at roughly $12 billion. Asia Pacific sits in third with $9 billion over seven deals. This marks the region’s first year on year decline since 2020, when volumes collapsed as a result of fraud cases.

The Middle East recorded two sizeable deals for a total volume of $2.67 billion, placing it fourth in the regional rankings. Abu Dhabi National Energy Company (TAQA) secured a $1.5 billion dual-tranche green bond offering in April, while OQ Trading, formerly known as Oman Trading International, completed a $1.175 billion borrowing base facility in June. However, the region has failed to reach the peaks of 2021, when it recorded $27 billion in activity.

Trafigura remains one of the most active borrowers in the market with more than $10 billion in completed deals recorded by TXF. This includes the refinancing of an annual $1.9 billion revolving credit facility and an increased $3.5 billion three-year deal. Gunvor sits in fourth with $2.2 billion of finance across three deals. It recently announced an off-balance sheet RCF featuring the support of three export credit agencies: Euler Hermes, Credendo and Atradius.

Just last year Trafigura made headlines with two Euler Hermes-backed deals that were linked to the supply of key commodities for German industry. Mercuria has followed this path in 2023 with a €500 million SACE loan linked to the delivery of LNG supplies to Italy. ECAs have shown flexibility in their dealings with commodity traders as they look to develop their support for national industries beyond pure export credits.

Glencore returned to the market in April with a refinancing of its major revolving credit facilities. They now include a $9.06 billion one-year RCF and a $3.9 billion medium term facility. In June Glencore received $1 billion in cash as part of Bunge’s merger with Viterra for its 50% stake in the agri-trader. It has retained a 15% stake in the new entity, which is set to become one of the largest players in the soft commodities markets.

There is time for a recovery in 2023, and the second half of the year generally produces significantly greater volumes. However, if these trends are maintained through 2023 then the industry will have suffered damaging losses that could drive more firms out of business. The impact of the so-called ‘flight to quality’ has never been more apparent.

The Global Commodity Trade Finance Industry Survey 2023

Take part in our annual commodity finance survey, designed so that banks, brokers, traders, producers and insurers can all have their say! This should take no more than 15 minutes to complete and your responses will be confidential. Have your say here: https://www.surveymonkey.com/r/BPVZRSW