TXF at 10: Top tropes of the decade

To celebrate 10 years of TXF, the Intelligence team has outlined a decade of data to bring you the top tropes in export finance. The fragmentation of trade has pushed export finance to develop an increasingly flexible product offering, but one that is often limited to the same old players.

At the latest edition of TXF Global Export Finance in Lisbon, TXF marked its 10th birthday with the market in style. It was a celebratory moment, but there was time for reflection on the key developments in the export finance community over the past 10 years. TXF now has a decade of data to draw upon from its user-driven intelligence product. Through a mixture of deal submissions and market survey reports, TXF’s database offers the most accurate and up-to-date information on the latest trends in export finance.

TXF Intelligence can now leverage the power of that database to bring you the top tropes from the last decade. Below you will find seven commonly held assumptions about the export finance markets as well as accompanying data analysis that will either support or refute those statements.

1. Greater fragmentation?

It is often said that after the stresses of consecutive macroeconomic black swan events, banks are increasingly cautious in their appetite for new sectors and geographies. They prefer now to focus on long-standing clients and projects that are deemed suitably ‘relevant’. Banks are no longer capable of financing anything anywhere if they ever were.

The data supports this view to some extent; the results from TXF’s annual market sentiment survey show that almost 40% of bank respondents consider export finance to be “a long-standing profitable business and a core product of the bank”. While it is promising that so many respondents have dedicated export finance teams, it should be noted that roughly 50% of the survey described export finance either as “a relationship-driven product we offer to key clients” or “a product we use from time to time”. This would suggest that for a large portion of the banking industry, export finance is offered only occasionally to sectors and clients that they know and trust.

This is not simply a problem related to credit risk in export finance. Banks must consider a range of challenges on every new deal, each of which adds to the burden of due diligence and KYC (know your customer checks). Geography, sector, client, currency and much more besides all have an impact. Taken together, it should come as little surprise that many banks are discouraged from entering new markets. As one borrower respondent put it to TXF, “KYC was painful and onboarding can now take up to a year… Banks need a more flexible approach and more people who are knowledgeable about how the industry works - not all data gathered for KYC is helpful in avoiding fraud”.

2. Greater concentration risk?

One concern that is often related to fragmentation is concentration risk. Fewer large banks and suppliers operate in the market, meaning that big-ticket projects tend to be dominated by the same players. This can lead to accusations of anti-competitiveness; banks, exporters and buyers stick to their preferred partners, reducing opportunities for new players that could offer fresh creativity to the industry.

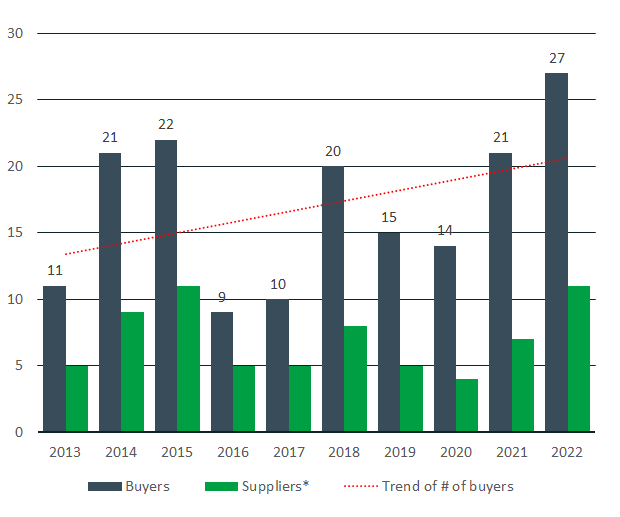

On this point, the data offers mixed results. On the one hand, the number of large buyers and suppliers has increased over the 10 years of TXF. The number of buyers making up 50% of market volumes sat at 11 in 2013, but this has increased to 27 in 2022. Just 32% of borrowers have completed three or more ECA-backed deals in the last decade. This suggests that the market is not replete with just a handful of borrowers returning for new deals every few years.

For a counterargument, the average number of buyers representing 50% of ECA-backed activity over the decade is just 17. While the trend is upwards, the borrower market is hardly diverse. This reinforces the notion that banks are chasing a similar set of clients, perhaps at the expense of new exporters. The slow death of oil & gas may yet change this, as small-scale projects in the renewables market open up opportunities for new players.

No. of buyers/suppliers making up 50% of market volumes

No. of buyers/suppliers making up 50% of market volumes3. Larger ticket sizes?

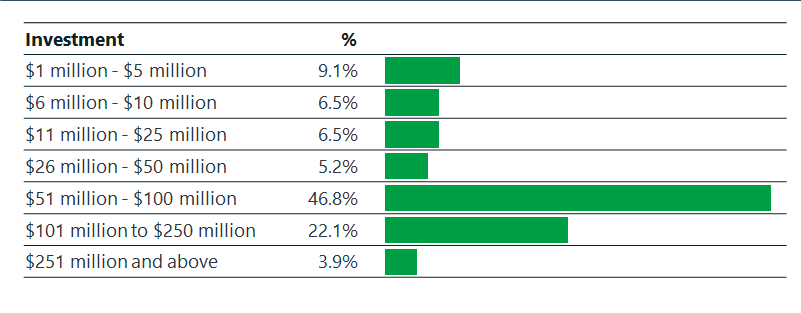

This argument suggests that banks are less interested in small deals. It is said that they prefer large projects where risk is distributed between many participants. Consequently, this also suggests that bank participation in these large deals is going up as well. In reality, ticket size has trended downwards since 2013. From an average ticket size of $87 million, in 2022 this number reached $69 million. The top 25 export finance banks have steadily increased the number of deals they complete to roughly 25 deals per year, but volumes have not kept up with this increase. More deals are being completed, but for the same volumes.

What is your average ticket size per transaction? TXF Export Finance Industry Report 2022

What is your average ticket size per transaction? TXF Export Finance Industry Report 20224. Developed markets over developing markets?

Export finance is increasingly focused on projects in developed countries. This can be seen as an indictment of risk appetites in ECAs and banks for fragile economies. Since the top export finance banks are located in Europe, they have increasingly turned to their familiar home markets as a response to macroeconomic uncertainty. It could also be seen as a victory for renewables projects, with developed economies investing more in new green technology that benefits from ECA support.

Interestingly, there has been little change here since 2013. High and upper middle-income countries are well-entrenched as recipients of ECA support. In 2022 their combined volumes reached more than $75 billion, while lower middle- and low-income countries received a little over $25 billion. In 2013 the corresponding figures were $68 billion and $19 billion respectively. According to TXF’s industry survey, credit risk is the greatest factor preventing more investment in developing markets.

This may change as reforms to the OECD Arrangement come into force. They should allow ECAs to offer more flexible terms to borrowers operating in these markets, but many are still unconvinced. One exporter told TXF “On social and energy projects, I still think premiums are too high for the risk the ECA has taken. In Africa and other countries that are category six and seven, the OECD should have a better look at the need to evolve to grow the infrastructure space”.

5. Shift in sectors?

There are few surprises here. Oil & gas has seen a significant decline over 10 years of TXF, but it is still the largest recorded sector according to volume over this period at $246 billion. In 2022 it made up just 7% of the market, down from almost 35% in 2013. Oil has taken the brunt of this decline, while gas has trended upwards slightly. Expect this difference to become even more pronounced next year if gas projects continue to be supported in the wake of Russia’s invasion of Ukraine. However, in the long-term, the outlook for gas is similarly bleak.

Infrastructure, renewables and manufacturing have grown dramatically to become the bread and butter of the industry. Together they made up 40% of the market in 2022. Expect to see developments in the mining industry and agriculture as countries look to secure supplies of key commodities.

6. ECAs are increasingly politically charged?

This is the notion that ECAs are now directed by political mandates and governmental policies first and foremost. Of course, as promoters of national exports, they will always be politicised entities. However, this argument suggests that the fragmentation of trade as well as growing conflict between major international players has pushed the needs of buyers and exporters to the background. In other words, ECAs have been affected by the end of the era of unshackled free trade.

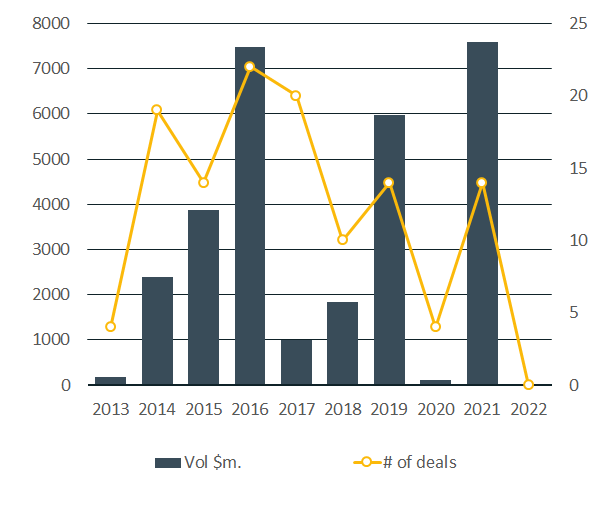

It is promising to note that there has been no obvious pullback on the number of distinct countries on deals. On average, between 80 and 100 countries per year are recorded on TXF’s database. This suggests that ECAs are not significantly affected by the fluctuating alliances of international politics. There is a limit to this flexibility, as shown by the sanctions placed on Russia in the last year. ECA activity in Russia was maintained through the 2010s despite frosty relations with western governments and sanctions in the wake of the invasion of Crimea.

However, the shutdown on business activity imposed since the invasion of Ukraine has seen ECA activity fall to nothing. The fines for banks contravening those sanctions have no limit. One bank told TXF ““We're learning from recent geopolitical events that following the conflict in Ukraine certain entities are trying to divert Russian exports… It is absolutely key that all banks ensure that we have systems in place to catch that. The risk for us for getting that wrong far outweighs the benefit of doing transactions more quickly”.

ECA Activity in Russia

ECA Activity in Russia7. ECAs are now faster than banks?

ECAs have been asked by governments to offer more flexibility to exporters in the wake of the COVID-19 pandemic. One consequence of this has been a reduction in structured export finance transactions. Vanilla corporate financings have become more common in their place, since they place fewer restrictions on the borrower. It is certainly true that vanilla deals were more common in 2022 than ever. They are still a minority of the market at less than $20 billion.

ECAs are rarely praised for their speed of transaction, but their services in the pandemic were essential to many industries that could not generate revenue in a lockdown. Special liquidity facilities and payment holidays were provided in record time. Perhaps as a consequence of this unprecedented support, ECAs now play a much broader role in supporting national interest than pure export credits. To some, direct ECA lending has already encroached too far upon the territory of commercial banks. A convergence with commodity trade finance, as shown by Trafigura’s partnership with Euler Hermes, suggests that this trend is set to continue.

For more information on the top tropes of the decade, subscribers to TXF Intelligence can view the panel session titled ‘Top tropes of the decade’ from TXF Global Export Finance, featuring Alfonso Olivas, TXF’s Head of Data and Digital Product and Gabriel Buck, Managing Director at GKB Ventures. For those interested in a subscription to TXF’s data product, please contact intelligence@exilegroup.com.

Become a subscriber today for unrestricted access to the best export, trade and commodity finance analysis available.

Click here for information on the different packages available for you and your team

Exclusive subscriber-only content published last week:

TXF Global: Chair Lewis on the lands of opportunity

TXF spoke with US Exim’s Chair Reta Jo Lewis to outline the US ECA's revised mission statement in the wake of the pandemic and energy crisis and why support to specific regions will mushroom.

New senior trade finance underwriter hires at AIG

AIG boosts its trade finance underwriting team in Europe with two hire.

Fournis joins Green Tie Capital

Erwan Fournis – previously global head of project finance at Operis – has joined Green Tie Capital as managing director.

RGreen Invest to exceed second close target

French asset manager RGreen Invest will surpass its €100 million ($109 million) goal on the Afrigreen Debt Impact Fund in a second closing by the end of summer, with its hard cap due by year-end.

AIIB mulls $95m for 400MW solar in India

AIIB is considering a $95 million investment into a 400MWAC solar power project in Gujarat, India.

Standard Bank taps IFC for renewable portfolio

Standard Bank of South Africa (SBSA) is due to sign a 7-year $250 million loan with IFC to fund its renewable energy portfolio over the summer.

Greece’s PPP water pipeline of projects are progressing, with the EBRD supporting three water-related projects in an advisory capacity.

Paul Coles has joined supply chain finance provider Orbian as director, treasury.