Russia/Ukraine: economic fallout will be extreme!

Beyond the horrors and dreadful tragedies of the war in Ukraine there will be extreme economic fallout in the trade and investment space for many years to come. The conflict and sanctions imposed so far leaves banks, businesses and commodity trade severely exposed. What alternative supply solutions can be found?

In the wake of the Russian invasion of Ukraine, condemnation has been loud and clear from all but a handful of countries. With military intervention from the West ruled out, the almost immediate response from the US, EU and UK has been a succession of sanctions levelled at certain Russian banks, companies, officials and individuals designed to hit/cripple Russia financially.

Outside of Russia and Europe, most of the rest of the world has yet to properly wake up to the devastating implications of these widespread sanctions, and how it will impact them directly and indirectly. What happens with trade and the supply of so many crucial commodities that Russia produces and exports? And what happens with financing already in place for Russian projects? On the export finance front, the conflict and sanctions has left project borrowers, international lenders, export credit agencies (ECAs), and private insurers asking how much exposure to Russian assets are on their respective books? In a feature article TXF Intelligence takes a closer look based on export finance data over the past four years. The article also lists Russian banks and entities currently impacted by sanctions.

Also see the sister article Commodity trade: European banks most exposed to Russian risk

While there are many who believe that sanctions simply do not work, there is little doubt that these sanctions will have a devastating impact on Russia’s involvement in international financial markets, the ability to trade freely and will isolate Russia as a pariah state. Already the rouble has collapsed by at least 40%, the Russian Central Bank (RCB) has raised interest rates from 9.5% to 20%, and roughly half the country’s foreign exchange reserves of $640 billion sitting overseas have been frozen.

On the commodity front, with Russia being a leading producer and exporter of so many important raw materials (see below), the war and sanctions at the very least will lead to increased prices for many commodities which have already seen hikes over the past year. But it will also lead to disruption of the supply of commodities crucial to many industries in the rest of the world, and particularly so in Europe.

One of the anomalies (to put it politely) of the sanctions imposed is that Russia is still allowed to export its natural gas and oil and receive payments. Why? This is largely because the EU is reliant on Russia for approximately 40% of its natural gas supplies, and for around 20% of its crude oil. The UK only gets about 5% of its gas supplies from Russia. Because of the global market and current tight supplies this is certainly not something that can be totally replaced by other countries in the short term. In this respect, Russia has Europe by the balls. While on the other hand, Russia needs that vital stream of foreign exchange particularly as other streams of export revenue dry up. Touché!

And although it is probably obvious, it needs to be stressed that once sanctions are in place, they will take one huge effort to remove and repair the damage done. We will all be impacted in one way or another for a long time to come.

Without doubt the Kremlin fully expected retaliation from the West in the form of sanctions. But it is unlikely that the full extent of these sanctions was expected. Of course, Russia still has the option to switch off gas and oil exports totally which would ultimately cause chaos in supply in Europe. Should such a scenario take place a further range of economic sanctions would certainly be imposed. However, Russia turning off the tap is unlikely as Putin needs the money to fund his war machine. Ultimately, with Putin in power, Europe needs to wean itself off Russian gas but that is not going to happen fast (see below).

Already, some Russian banks have been taken out of Swift, the global electronic payment system, and more could follow. Beyond the banking sector, some big Russian corporates are facing very difficult times as foreign partners pull out of joint ventures and their share value gets heavily eroded. Fallout is likely to be widespread, and the eventual scale is probably one not fully anticipated by the Kremlin. The question must now be asked: just how far has Putin now inadvertently alienated himself from Russia’s industrial elite? The answer is considerably as the empires that they have built up see increasing devaluation. The other question to ask is does Putin care? You decide!

On 2 March Gazprom saw an unprecedented collapse on the London Stock Exchange with a drop of 97% in a single day. At the start of this year the company had a capitalisation of $68 billion, and by 11.30 am this morning that had crashed to $248.6 million. Russian steel, mining and vanadium producer Evraz along with gold producer Polymetal International have also had their shares hammered on the FTSE 100.

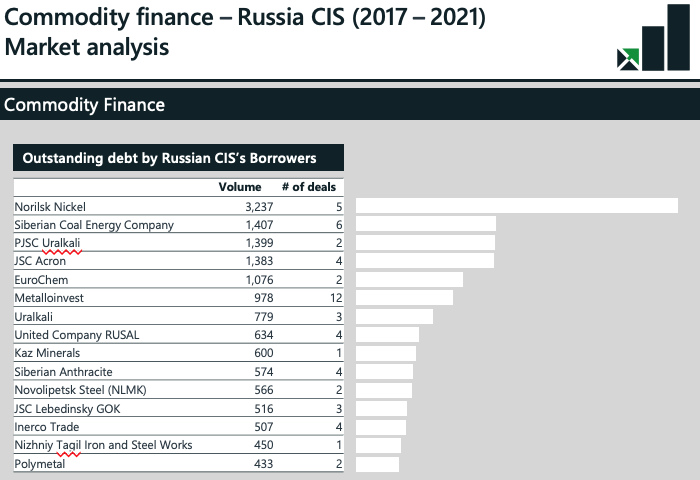

Table from TXF Data

Many non-Russian multinationals have been distancing themselves (or trying to) from Russian activities and investments over the past week or so. Perhaps none has been more spectacular than the announcement from BP which declared that it would exit its stake in Russian state-owned oil company Rosneft valued at an estimated $14 billion. However, no mention was made as to who would buy the stake. The decision has significant financial repercussions for BP, and the company has said it would write down up to $25 billion at the end of the first quarter of 2022. Shortly after this, the Russian government issued a statement prohibiting foreign firms from selling stakes in joint ventures with Russian entities.

On 1 March Shell also said that it will exit all its Russian operations, including the flagship Sakhalin-2 LNG plant in which it holds a 27.5% stake, and which is 50% owned and operated by Gazprom. At the end of 2021 Shell had around $3 billion in non-current assets in these ventures in Russia. Norway’s Equinor has also said that it will pull out of its investments with several Russian operators. And Exxon Mobil announced that it will also pull out of Russian oil and gas operations that it has valued at more than $4 billion. Most of these are production facilities on Sakhalin Island. It will also halt any new investment in Russia. Further divestment by other foreign companies is highly likely say oil & gas analysts.

Commodity trading companies which handle a range of commodities have been relatively quiet so far in relation to their operations in Russia and Ukraine. On 2 March though, Trafigura had this to say: “Trafigura does not operate any assets in Russia, and we have no directors or corporate officers in any external Russian entity. Following news of the terrible violence being inflicted, we immediately froze our investments in Russia. We are now reviewing the options in respect of our passive shareholding in Vostok Oil in which we have no operational or managerial input.”

Glencore also issued a statement on 1 March, saying: “Glencore condemns the actions taken by the Russian government against the people of Ukraine. We have no operational footprint in Russia and our trading exposure is not material for Glencore. We are reviewing all our business activities in the country including our equity stakes in En+ [aluminium] and Rosneft. The human impact of this conflict is devastating.”

And oil and gas trading company Gunvor, put out a statement on 3 March saying: “While Gunvor has a history working in Russia, the company’s trading today has no material exposure to the country. Since 2014, Gunvor has been majority owned by the company’s chairman and CEO, Torbjorn Tornqvist, who today holds 88.4% of shares, with the entire remainder held by Gunvor employees. There are no outside shareholders or economic interests, Russian or otherwise. Gunvor divested its entire Russian asset portfolio in 2015, with the exception of a minority, non-controlling stake in the Ust-Luga Oil Products terminal, which is currently being reviewed. Gunvor has no other material tangible assets in Russia.”

With so many big-name companies and traders pulling out or distancing themselves from Russia, it is really hard to see how others can stay. It is fair to expect that pressure is mounting on others to follow suit.

The energy quandary

Not surprisingly perhaps, the price of Brent crude on 2 March shot up to $118 per barrel, the highest since February 2013.

Commenting on this latest hike, Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown, says: ''Anxiety is again rippling through global financial markets with the fear of stagflation taking hold, as the Ukraine conflict ratchets up inflationary pressures and threatens to derail global growth. The price of oil spiked at $110 a barrel early on Wednesday [morning], piling pressure on companies and consumers.

“The upward march has been fuelled by warnings from the International Energy Agency that global energy security is now under threat and the release of emergency supplies by members including the US and Japan has done little to calm prices. President Biden is under increasing pressure from US lawmakers to suspend crude imports from Russia. Hitting Russia even harder with boycotts will cause a sharp ricochet of financial pain but it is a price corporations and politicians believe needs to be paid to try and bring an end to Moscow’s aggression.”

Streeter adds: “The worry is that it will do little to break Russia’s immediate resolve, which could lead to a long, drawn-out economic conflict. [There are] concerns that Russia will stop [gas] supplies to the region in a retaliatory measure and worries about pipelines being damaged in the conflict. Germany, highly reliant on the taps being kept on, says it is prepared if Russia makes that move, and will fall back on coal plants while intensifying the shift to renewables.”

In Germany’s case the country has been burning much more coal in order to keep its lights on. We can expect more of this. Currently, Germany is reliant on Russian gas for almost 60% of its gas supplies, and had been relying on natural gas to see it through much of the energy transition. The construction of the 1,200km Nord Stream 2 gas pipeline from Russia to Germany, at a cost of over $11 billion, was expected to be a major part of this plan.

The Nord Stream 2 project, which was completed in September 2021, has been a painful saga over the past few years, with constant opposition from the US in particular, as Washington sees an over-reliance on Russian supplies, while at the same time naturally wants to sell more US-produced gas to Europe. Out of all the suppliers, the US shale gas producers probably can ramp up production more swiftly than others globally.

The owner of the pipeline is Swiss-registered Nord Stream 2 AG, which is ultimately owned by sanctioned Gazprom. The company was targeted in US sanctions by the and an executive order issued by the US Treasury Department's Office of Foreign Assets Control directed “the wind down of transactions involving Nord Stream 2 AG,” as well as “any entity in which Nord Stream 2 AG owns, directly or indirectly, a 50% or greater interest” by March 2.

Gazprom paid half the cost of building Nord Stream 2, with the remainder of the project financed by oil and gas major Shell, Austria's OMV, France's Engie and Germany's Uniper and Wintershall DEA. Reports from Switzerland indicate that Nord Stream 2 AG is filing for bankruptcy and that all staff have been dismissed.

European Commission President Ursula von der Leyen has argued that even in the scenario of a full disruption of gas supplies from Russia, Europe is safe for this winter. At a press conference in Brussels last week, von der Leyen suggested Russian gas could be replaced with LNG imports from "more reliable partners". Then on Sunday, Chancellor Olaf Scholz announced that Germany will quickly build two LNG import terminals – the country's first – to help reduce its dependence on Russian gas. It will also look to buy more gas on world markets in coordination with the EU and increase its gas stocks through long-term storage.

The transition to renewables for Germany is painfully slow, although the current situation of reliance on Russian gas and the need to burn coal should push the renewables development programme ahead much faster now. This will also apply to much of the rest of the EU. Of all the EU countries, Italy and Austria are most reliant on Russian gas. In the meantime, sourcing more natural gas from other countries will be high on the agenda and will be an opportunity for some that have spare capacity – most notably Norway, Algeria, the US and Australia. According to Platts Analytics, Norway could provide the biggest boost for the rest of Europe, with an estimated 13 billion cubic meters (bcm) of production upside. Currently, after the 40% of gas supplied by Russia to the EU, Norway supplies around 20%, Algeria 12%, the US around 5%, Qatar 4.8% and Nigeria 4.4%. But the huge scale of Russian gas exports to Europe cannot be underestimated – in 2020 for example, Russia supplied a total of 175 bcm of gas to Europe.

Last week member states of the Gas Exporting Countries Forum (GECF) met in Doha, Qatar to discuss the impact of the mounting tensions between Russia and Ukraine and its impact on the global gas market. In the Doha Declaration – issued after the meeting concluded – parties emphasised that despite their commitment to increasing gas production to meet growing energy demand globally, they do not have the capacity to help Europe replace 40% of its energy consumption in the event Russia cuts supply.

However, African producers are looking to attract investments required to build infrastructure that would enable them to expand exploration, production and exportation to meet the anticipated increase in demand in Europe. A number of countries are ramping up production including Nigeria and Niger. The development of the 4,128km Trans-Saharan Gas Pipeline, which will run through the three countries into Europe – could now have an opportunity to attract funding for the project rollout. If completed, the pipeline is expected to transport 30 billion bcm of gas per annum to Europe.

Algeria’s proximity and pipeline to the European market makes the country of strategic importance as a potential gas supplier for Europe. In 2021, Algeria increased its export volumes of gas to Europe to 53 bcm from 40 bcm in 2020. Algeria, the world’s sixth largest gas exporter and the largest gas producer in Africa, has already expressed its plan to double exploration and production in the next five years. Platts Analytics estimates Algeria could provide an additional 7 bcm of gas to Europe in 2022, largely through higher shipments via the Transmed pipeline to Italy.

Speaking with an export finance banker earlier this week about gas projects in Mozambique, the banker opined that with the Russia-Ukraine situation getting worse it could provide a new green light for stalled ECA-backed multi-billion projects in that country.

At Africa-Middle East risk consultancy Pangea-Risk, CEO Robert Besseling states: “War in Europe offers a long-term opportunity for African natural gas exporters as European countries seek to diversify supply. Tanzania hopes to attract $30 billion in foreign direct investment into its offshore gas projects by next year. Senegal is due to start gas production this year, while existing suppliers to European markets, such as Nigeria and Algeria, are embarking on the $13 billion Trans-Saharan Gas Pipeline, along with Niger.”

He adds: “European banks will be prime financiers of such projects, particularly since the EU is considering natural gas to be a ‘green’ energy source. Middle East gas producers are similarly scaling up supply to Europe. There is a parallel opportunity for some African metal producers, particularly South Africa’s palladium and gold markets. Higher oil prices bode well for crude exporters such as Angola and South Sudan, as well as the Gulf region.”

Metals, fertiliser and softs

While much of the current focus around commodities is on the supply of gas and oil from Russia, it needs to be stressed that Russia is a massively important producer of a range of other commodities and generates significant revenue from the export of these. Disruptions in supply will only lead to further price hikes in a market which has seen a range of raw material commodities reach record highs over the past year.

Palladium has been one of the best performing precious metals not just in the past year, but over the past decade. Russia is the leading producer – accounting for a massive 40% of supply, and exporter of the metal, which is largely used in the auto industry but also in a range of electronics. South Africa, as the next biggest producer, stands to gain if Russian supplies are cut.

Nickel is a major export earner for Russia with Norilsk Nickel (Nornickel) being the world’s largest producer of nickel and palladium. Russian exports of nickel account for around 6% of global supply. Last week the price of nickel hit a 10-year high at $27,700 per tonne. The metal is vital for industries involved in the energy transition – electric vehicles, batteries, wind turbines etc. It is also used heavily in the production of stainless steel. Recent analyst assessments reveal that global stocks are low, hence the big jump in price. The current situation could see increased supply problems.

Aluminium from Russia is hugely important for the world’s auto and aerospace producers, as well as a vast range of consumer goods. This week the price of LME aluminium hit a high of $3,650 per tonne, and so far this year the metal is up 30% on the LME. Russian costs for producing aluminium are cheap compared to many other parts of the world – because it is so energy intensive; and much of Russian production is now labelled ‘green’ aluminium as it is produced with hydro energy sources. Russia produces around 6% of global supplies. Any curtailment of Russian exports could see a huge increase in cost of the metal elsewhere particularly so with increasing energy prices.

Russia is the world’s biggest exporter of fertiliser – and prices have already rocketed over the past year. Russian producers source their working capital credit lines from primarily Western banks. Although none of the fertiliser companies are sanctioned, like other companies they will be hit by the ban on any new trade financing facilities. For the time being companies will use existing credit lines.

On the softs front, Russia is the largest exporter of wheat in the world and Ukraine is the fourth. Both countries are leading producers of maize, barley and oilseeds such as sunflower. According to the USDA in 2020/2021 Russia and Ukraine combined accounted for approximately 26% of global wheat exports, 46% of global barley exports, and 16% of global maize (corn) exports. In addition on the oilseeds front, Ukraine and Russia combined accounted for a staggering 80% of global exports in sunflower seed meal and sunflower seed oil in 2020/2021. Infrastructural destruction in Ukraine could see grain production hit and facilities for export damaged – particularly in the Black Sea export ports. Ukrainian ports are already shut. Although Russian Black Sea ports remain open, traders and shippers are reluctant to use them because of the war and related sanctions. The bulk of the Ukrainian grain crop goes to North Africa and the Middle East, where prices can expect to rise sharply. With stocks relatively low in many Middle Eastern countries, the scramble to find alternative sources of grain supplies is ramping up - with Argentina, Brazil and Canada being the most targeted suppliers so far. US wheat futures have surged 40% this week alone.

Commenting on the changed environment for commodity trading, Simon Ring, global head of Maritime & Trade Technologies & ESG at Pole Star, says: “Sanctions always come at a price. The measures taken against Russia have led to rocketing prices for fuel, wheat, aluminium, and metals such as palladium and nickel. Mainstream businesses in the western economies are treating any Russian involvement as potentially toxic.

“These effects will take a very long time to unwind, and it could be years before we get to normal business relationships with Russian companies. Even if a ceasefire takes effect, uncertainty will prevail for the foreseeable future, especially as commodity production and extraction in Russia is heavily linked to proscribed banks, oligarchs and individuals in the government.

“The financing of trade in these commodities will remain highly problematical with banks having to remain compliant with constantly updated regulation or risk severe penalties. The onus will be on commodity trading companies, financial institutions and trade finance platforms to know who and what they are dealing with. It is very tough, but not impossible.”

And from a Middle East and African perspective, Robert Besseling, CEO at Pangea-Risk, comments: “Despite such obvious long-term opportunities, the immediate impact of the war will be felt by Africans and Middle East countries through rising fuel and bread prices, as well as broader accelerating inflation. Kenya, Ethiopia, Egypt, Sudan, Lebanon, and Jordan will have to raise bread prices, which could stoke protests and civil unrest.”

He adds: “In March, South Africa’s petrol pump prices will reach a record high. Other countries will refuse to cut fuel subsidies, as in Zambia and Nigeria. Major agricultural producers across the region will also be hit by rising fertiliser costs, which are also heavily subsidised by governments. Already stressed sovereigns will feel the fiscal pressures from higher expenditure on fuel and fertiliser subsidies, perhaps accelerating debt distress scenarios in some cases.”

Become a TXF subscriber for unrestricted access to TXFnews.com 365 days a year

Contact us for individual and team rates by emailing subscriptions@txfmedia.com

Take a look below at some of the exclusive subscriber articles published last week

Ukraine Trade Risk Briefing: There is no such thing as a winnable trade war

Rebecca Harding, CEO of Coriolis Technologies discusses the very fluid situation in Ukraine with TXF in regards to how it impacts global trade – from the perspectives of sanctions on Russia, financial flows, payments and physical trade. Trade wars are not likely to be winnable...Read on here

Greek project finance on the mend

Since the country's financial meltdown, project finance lending in Greece has slowly made a comeback in tandem with DFI support for a growing renewable energy and PPP project pipeline – but will that lending landscape change as more projects come to market?...Read on here

Metallurgical and thermal coal: Different cokes for different folks?

Provisional results from TXF's annual Export Finance Industry Survey indicate that the retreat by export finance banks and ECAs from coal is very real. But it is also largely indiscriminate in its...Read on here

DFC pulls funding for Tulu Moye geothermal project

The US International Development Finance Corporation (DFC) has dropped out of the lender-line up from the solely DFI-backed 50MW first phase of...Read on here

Sydney Metro West progressing

Sydney Metro is said to be considering a contractor-based hybrid structure rather than...Read on here

Banks to bid on graphite mining project outside of China

Canada-listed Nouveau Monde Graphite is asking lenders to bid on its...Read on here

Atico secures $10m loan and proposal for further financing from Trafigura

Copper and gold project developer Atico Mining has entered a 30-month...Read on here

GCB Bank raises $117m trade finance facility

GCB Bank, previously known as Ghana Commercial Bank, has secured a six-month $117 million syndicated trade finance facility, with...Read on here

PLN to launch bidding process for 250MW of renewable IPPs

Indonesian state-owned electricity utility PLN plans to launch the bidding process for a total capacity of...Read on here

APA wins right to buy Basslink debt

Following its secondary market acquisition of A$99 million of Basslink project debt in November 2021, APA Group has won the right to...Read on here

Santander puts up financing for Onex wind portfolio acquisition

A few more details have emerged on the financing of Onex Holding’s recent acquisition of a 221MW wind portfolio in Portugal from EDP Renovables (EDPR)...Read on here

Verizon prepares to sell offshore bond

Verizon (Baa1/BBB+/A-) is set to return to the Swiss franc bond market for the third time, as it prepares to sell its...Read on here

MUFG’s Hessing promoted to EMEA head of STF origination

Sandie Hessing has been promoted to EMEA head of structured trade finance origination, within the ECA, commodity & structured trade finance remit at MUFG...Read on here