TCFD: Too complex for delivery in export finance?

The Global Export Finance Industry Report 2021 found that export finance banks (59%), ECAs (59%), and buyers (54%) were most likely to have some knowledge of Task Force on Climate-Related Financial Disclosures (TCFD), with more exporters (51%) likely to have no knowledge of the framework. Moreover, when asked about their company’s commitment to TCFD, one-third of ECAs and exporters, 27% of buyers and 13% of banks do not currently follow TCFD reporting standards.

The Doomsday Clock ticks ever closer

On 23 January 2020, the Bulletin of the Atomic Scientists moved the Doomsday Clock to read 100 seconds to midnight, the closest that human civilisation has ever been to complete oblivion. To put this into context, in 1947 when the concept of the Doomsday Clock was first introduced, the clock read 7 minutes to midnight. Over the years it has fluctuated but in 1991, it read 17 minutes to midnight – a position that largely reflected the end of the Cold War and a global effort to reduce the threat of nuclear war.

Since then, the world has been thrust a further 15 minutes and 40 seconds closer to Armageddon. The ongoing threat of nuclear war continues to be one of the driving reasons behind this move forward, and for decades, it has often been at the heart of international politics.

The other cause however, receives, in comparison, far less attention. That cause is climate change.

Prevailing data presents a bleak picture. In the last decade alone, the record for the hottest year on record has been broken three times (2014, 2016 and 2020) (Thompson, 2021) and the number of hydrometeorological (floods, storms, and heatwaves) and climatological disasters (droughts and wildfires) are on the rise. Over the last 10 years, Hurricane Sandy in the US (2012), Typhoon Haiyan in the Philippines (2013), Hurricane Harvey in the US (2017), Hurricane Maria in Dominica and Puerto Rico (2017), Cyclone Idai in southern Africa (2019), and global wildfires in the Amazon, Indonesia and California (2019 and 2020) have claimed the lives of tens of thousands of people, displaced millions more, and caused trillions of dollars of damage. And natural disasters are showing no sign of abating.

The Emergency Event Database of the Centre for Research on the Epidemiology of Disasters shows that over the past four decades, the frequency of natural disasters has increased almost three-fold, from 1,300 events between 1975 and 1984, to nearly 4,000 in the latter parts of this decade. An independent evaluation by Asian Development Bank also found the number of Category 5 storms tripled between 1980 and 2008 (Asian Development Bank, 2013).

Despite the increasing frequency of natural disasters and the often permanent impact that they have on natural ecosystems and human welfare, very little is being done to tackle the looming threat of climate change. It is true that many countries have started to tackle climate change head on, but others – including the United States who, until recently, had withdrawn from the Paris Agreement, and Brazil, which dismantled policies to protect the Amazon rainforest – have taken massive strides backwards. This is being reflected in the numbers. A recent report by the United Nation revealed the world is on track to produce far more coal, oil and gas than is consistent with limiting global warming to 2oC, one of the fundamental goals of the Paris Agreement.

Looking more specifically at export finance, an industry that is synonymous with major oil and gas, power and petrochemical projects, the picture is a little brighter. For the first time since recording closed deal data, renewable energy project financing surpassed traditional power projects. In 2020, TXF Data recorded a total deal volume for renewable energy projects of $16.6 billion, $2.3 billion more than traditional power projects ($14.3 billion). The largest of these projects was massive $7.3 billion Bpifrance, EKN and GIEK-backed Dogger Bank wind farm off the north coast of the United Kingdom (UK).

However, climate change does not just have an impact on the environment. It can also cause major disruption to business operations, and threaten assets and infrastructure, all of which can result in substantial financial losses. Recognising this, the Financial Stability Board established the TCFD.

A brief overview of TCFDs

The TCFD were set up by the Financial Stability Board (FSB), an international body that was established in 2009 by the Heads of State of the G20 countries. The FSB established a 32-member task force to develop voluntary, consistent, climate-related financial disclosures that would: “Help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities.” (Financial Stability Board, 2017)

In 2017, the TCFD outlined its key features and recommendations, namely to ensure the TCFD is adoptable by all organisations, is included in financial filings, is designed to solicit decision-useful, forward-looking information on financial projects, and to have a strong focus on risks and opportunities related to transition to a lower-carbon economy.

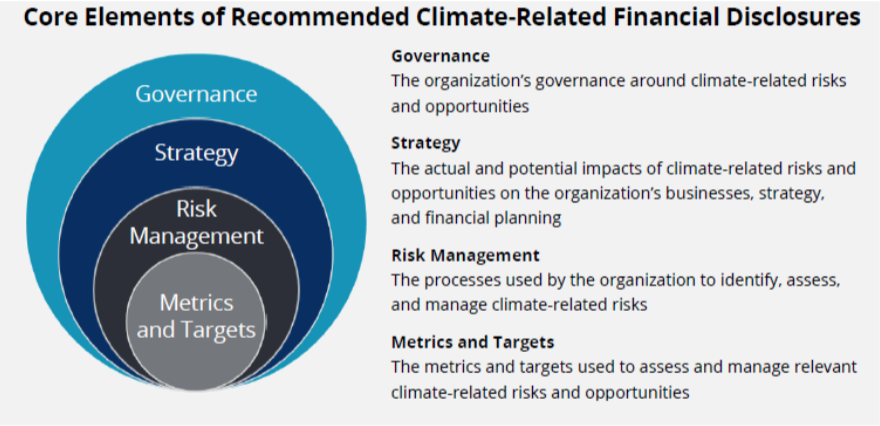

To meet these targets, four core elements were proposed:

To date, the 2020 TCFD status report noted that nearly 60% of the world’s 100 largest companies follow TCFD reporting standards, led by energy companies and materials and buildings companies, and 1,500 companies globally now follow TCFD, including 1,340 companies with market capitalisation of $12.6 trillion and financial institutions responsible for $150 trillion in assets under management (TCFD, 2020).

These actors are central to meeting the climate challenge. Meeting the Paris Agreement’s temperature target of limiting warming to 2C will require investment in low-carbon c.$130 billion per year between 2016 and 2030. Private finance will need to join public coffers if those levels of new investment are to be realized.

Moreover, the TCFD was Carney’s response to the risk of a ‘carbon bubble’ arising from an unmanaged transition impacting on capital markets value and financial stability. The core argument was that most financial actors were ignoring climate change risks, for a variety of reasons including the lack of transparency as to who was holding risky assets.

With this in mind, how well is TCFD understood within export finance?

TCFDs and export finance

The Global Export Finance Industry Report 2021 collected data from 452 individual respondents. Of these, 70% identified as either an exporter (58%) or a buyer (13%), 24% as a bank, and 6% as an ECA. Exploring TCFD, the report delved into how well the framework was understood across the different industry sectors, commitment to implementing TCFD, levels of intention to follow TCFD in the future, and potential barriers to TCFD being implemented more widely.

The report found that banks (59%), ECAs (59%), and buyers (54%) were most likely to have some knowledge of TCFD guidelines. However, approximately one-quarter of ECAs, one-third of banks and buyers, and more than half of the exporters had no knowledge of TCFDs. Given that the TCFD guidelines are fairly new to global industry, it is perhaps unsurprising that the level of knowledge across the survey respondents was not especially strong.

Lack of capacity, management experience and performance track record are the main factors limiting firms’ low-carbon investments. As noted above, the export credit sector has traditionally lacked data and operational experience of the low carbon sector. Accordingly, they may not be up to speed on what is standard practice in other, more climate-savvy, sectors. Note however, that some ECAs, such as EDC and UKEF are now in their second or third cycle of TCFD reporting.

Banks (58%) and ECAs (38%) were more likely to already be following TCFD guidelines, while exporters and buyers (both 46%) stated that they were unsure if they were following TCFD guidelines. Approximately one-third of ECAs and exporters, 27% of buyers and 13% of banks do not currently follow TCFD reporting standards.

ECAs (and attendant banks and exporters) are clearly split into leaders and laggards. The leaders are getting to grips with TCFD and learning-by-doing. The laggards appear to be adopting a ‘harvest-and-exit’ strategy which is climatically dangerous. If Mark Carney is correct, it is also financially disastrous, both for those firms and broader financial stability.

After the survey respondents received a brief explanation of what the goal of TCFD is, along with how these goals would be achieved, there was a somewhat ambivalent view as to whether each industry type would implement TCFDs in the future.

If companies are to commit to TCFD, it will be the decision of senior management. Looking specifically at data from those respondents who identified as either a global head or as a director, more than a third of the banking respondents and nearly half of the exporters and buyers have no intention to implement TCFD reporting standards at any point in the future. For those industry types that will look to implement TCFD in the future, banks (31%) were most likely to do so within the next 12 months, while ECAs (45%), exporters (30%) and buyers (38%) were most likely to do so within one to three years.

Short termism is a characteristic of firms which avoid TCFD reporting, often driven by the fact that their investment horizon (say 1-2 years) is very short compared with the likely materialisation of actual climate-related financial risks. Similarly, most portfolio managers are benchmarked on much shorter-term performance, as short as weekly. Investors may not be concerned about climate change if they estimate that the physical risks of climate change won’t directly affect the companies they are currently investing in. Policy is a solution to this, for example, by requiring that sustainability considerations are integrated in the decision-making process. To date though most such policy initiatives are weak. At the harder end, the UK Government’s Green Finance Strategy expects all listed companies and large asset owners to be disclosing in line with TCFD recommendations by 2022.

The qualitative data found that there were five reasons behind a reluctance to implement TCFD guidelines in the future.

- The fallout of Covid-19 has drawn the immediate attention of most companies, namely, to ensure they are able to continue operating in export finance long-term.

- Given that implementing TCFDs requires a substantial change in strategy and reporting, the guidelines were not a priority.

- Several interviewees noted that they will wait to see what others do in order to better understand the challenges posed by TCFD integration.

- It was noted that there were a number of different climate change-related initiatives, none of which can be considered the best framework for export finance.

- There was a reported lack of understanding of TCFD guidelines across companies which, in turn, fostered uncertainty; a barrier to implementing the framework.

Looking at potential barriers to implementing TCFD, most of the banks (79%), ECAs (75%), exporters (83%) and buyers (61%) noted that reporting does not require them to divulge confidential or sensitive information that may undermine the company’s position.

The report also explored prevailing attitudes towards TCFD and whether it was regarded as a legitimate framework that could be appropriately implemented. When the respondents were asked if TCFD was just a ‘tickbox’ exercise, a third of banks, 42% of ECAs, and more than half of all exporters and buyers noted that it was.

The recent Australian case of McVeigh made clear that accounting for climate risks is far from a tickbox exercise. After years of litigation, the AU$57bn superfund REST agreed ‘that climate change is a material, direct and current financial risk to the superannuation fund…that REST, as a superannuation trustee, considers that it is important to actively identify and manage these issues’ (Pandey, 2020). Other financial actors will find themselves in similar positions if they view accounting for climate risk as a simplistic exercise.

Does the export finance need to follow TCFD?

The TCFD is an important step in understanding the physical, liability and transition risks associated with climate change, but it does have its shortcomings. Ongoing issues with commitment from senior leadership, low employee engagement, the time and resources needed to fully integrate TCFD, and inexperience in undertaking effective scenario analysis to support TCFD reporting are all reported barriers to TCFD being implemented globally (Marsh & McLennan, 2018).

There may be a scalar issue in terms of implementing TCFD. In its current format, TCFD appears to be aimed at the largest companies globally, with reputational kudos gained if they show a public commitment to the guidelines. However, for export finance, an industry comprised of thousands of much smaller companies, scaling down the framework so that it can be successfully implemented within these companies, could be a major hurdle. Moreover, there also appears to be limited incentive for these smaller companies to implement TCFD which, given the time and resources it takes, is likely to also prevent it being taken up across export finance.

That said, it is important not to overstate the burden of climate-risk reporting. The first TCFD report undertaken by EDC was not much longer than a page. Now preparing its such third round, EDC reports that it has learnt a great deal from the process, not least understanding its clients better, especially their preparedness for the low carbon transition.

Nonetheless, given the ambivalence that appears to exist across the industry on understanding and committing to TCFD, it may be some time for it to become commonplace.

However, a more fundamental question remains: Does the export finance industry need to implement TCFD?

While the TCFD is another useful framework, it is not the first to explicitly report a goal of improving market transparency and stability, nor is it the first framework to advocate a set of reporting standards that are designed to encourage sustainable investments across different industry sectors.

TCFD is perhaps best framed as another useful set of guidelines that can utilised to further tackle climate change. A recent report by the United Kingdom’s National Audit Office estimates that there are more than 200 international metrics to measure sustainability worldwide, each of which has their own set of parameters and indicators.

For instance, one of the most well-known frameworks is Sustainable Development Goals (SDG), a United Nations initiative that sets out 17 goals to “transform our world” (United Nations, 2015). Yet within the SDG, there are 231 unique indicators for companies to go ingest and implement.

To compound matters, no framework is considered industry-leading across export finance, and none provide a universally agreed definition of sustainability, what should be measured, or best practice for monitoring sustainability across the lifespan of the project. Many respondents referred to the specific initiatives they are implementing to become sustainable, but this was occurring in a fairly siloed manner.

Moreover, sustainability in export finance requires a more nuanced approach than what is currently being discussed. Every country on the planet will experience issues related to climate change in some form or other, but developing countries also have to contend with challenges relating to accessing suitable water and waste management concerns, the provision of clean water, a lack of educational opportunities and social housing challenges to name a few.

While there was a great deal of enthusiasm for the export finance industry to become more sustainable, there was an overriding sense of inertia across the industry when it came to tackling climate change and implementing sustainable practices. And the ECA market is still trying to find an appropriate measure for sustainability and the UN's SDGs, with a raft of different metrics - EU taxonomy, TCFD, green loan and equator principles - proving challenging. A 'one size fits all' framework would be ideal but market players say one measure for sustainability is unviable to roll out across the entire industry.