Working capital: The current challenge faced by the shipping industry - what, why, and what's next?

The coronavirus pandemic has reminded the trade community how paramount the maritime industry is to keeping global supply chains flowing. But will digitisation help lower the significant associated costs with the manual paper-based sector?

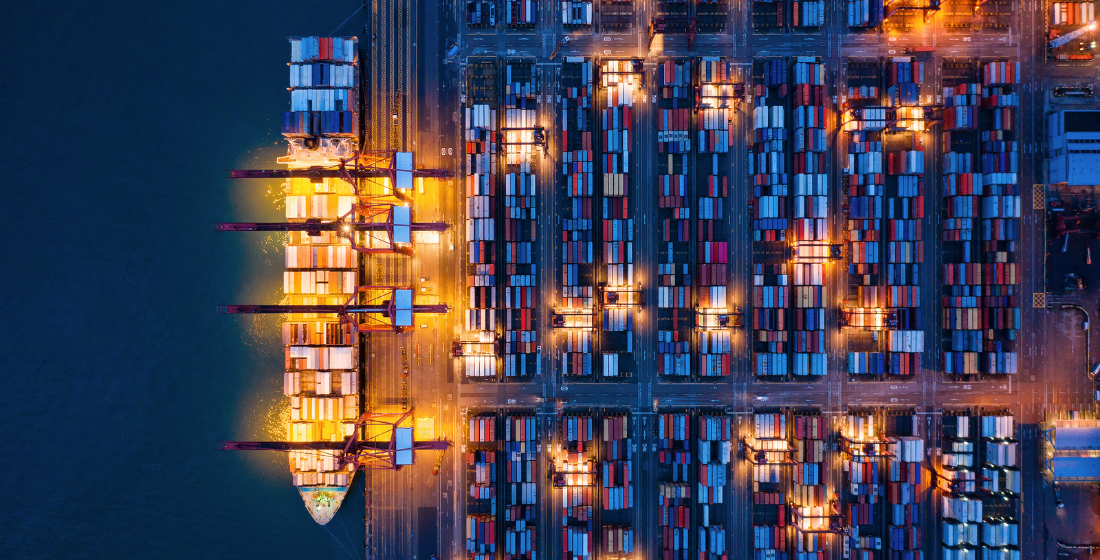

Since the outbreak began in Q1 2020, Covid-19 has highlighted the crucial role of the maritime industry in keeping global supply chains flowing. As the backbone of the world economy, the shipping industry transports 90% of world trade across the globe. In these difficult times, it is now more important than ever for shipping services to deliver essential goods and keep supply chains moving, both efficiently and in a compliant manner.

However, maritime trade faces enormous associated costs. Beyond general ship maintenance and staffing, fuel costs, canal toll fees, and port service fees all pose significant expenditures for those involved in maritime trade. At present, it costs an average of 200,000 USD for vessels to transit through the Panama Canal. Simultaneously, marine fuel procurement and purchasing are the highest operating costs for any ship owners and operators, taking up between 60-70% of total spend. The reduced volumes and activities are reinforcing the existing liquidity challenges, with key players currently facing short repayment terms, upfront payments between ship operators and service providers, and the very real risk of non-payment for service provision.

Moreover, processes within the maritime industry today are highly manual and paper-based, relying on a wide array of documentation including letters of credit, adding significant costs and operational overhead. Physical documents are slowing down processes significantly and are resulting in errors, corrections, duplications, and fraud that feed the vicious cycle of high costs and risks for all parties involved. On average, a cross-border trade finance transaction requires the exchange of 36 documents and 240 copies. This creates enormous challenges and inefficiencies for banks to process trade finance transactions.

The impact of Covid-19 on global trade

Bank trade financing operations typically require significant levels of in-person staffing to review hard-copy paper documentation, which is required as a matter of national law in many jurisdictions.

Since the pandemic began, maritime-based supply chains and the economy as a whole have been facing an array of both new issues, compounded by the pre-existing challenges described above.

A significant economic setback is anticipated globally as a result of the current crisis, with a credit crunch expected imminently. It is anticipated that world trade will decline by between 13-32% with virtually all regions suffering a double-digit trade volumes decline in 2020.

The shipping industry remains one of the most critical pieces needed to ensure the sustained flow of essential goods across borders and to keep supply chains intact during this unprecedented juncture.

While the need for more automated, streamlined processes at the intersection of trade and risk and compliance has certainly presented issues prior to the Covid-19 pandemic, the current crisis has brought these structural challenges to the forefront, with the need for solutions now more pressing than ever.

In the current environment, maritime trade can greatly benefit from access to affordable, easy-to-manage trade and working capital finance programs, which today underpin roughly 30% of global trade and play a significant role in managing risk and injecting liquidity into global supply chains. Keeping cash flowing smoothly is a key point of focus for the International Chamber of Commerce (ICC). John Denton, Secretary-General of the ICC has highlighted the importance of digital documentation, as well as removing the reliance on paper-based transaction processing, which currently afflicts the majority of the industry.

The current role of financial institutions in supporting shipping

With the economic impact of the pandemic and the resulting risk profile changes, banks are now reducing their exposure to the shipping industry and are less willing to extend credit. As such, there is an immediate and compelling need for the financial services industry to support the shipping industry through trade, and working capital finance programs that allow industry participants to access and manage the liquidity necessary to keep critical supply chains moving.

In order to catalyse the promotion and servicing of these programs, banks and their shipping industry clients need solutions that can provide high levels of visibility into the underlying transactions, alongside the ability to match the required trade data, coupled with strong compliance and reporting capabilities.

So what does the industry need?

In this environment, digital solutions that can solve these challenges, and thus allow for a new wave of financing solutions that can support the unique requirements of the maritime industry, are required. New digital financing programs need to support current business processes, compliance, and risk management requirements through specialised platforms and services. In turn, these must leverage and connect data as part of existing operational workflows and within a secure, low-cost, digital environment.

It is impossible for a single institution or service provider to build and offer this type of solution unilaterally. Instead, it requires new collaborations between financial institutions, trading parties, and technology companies to work together on the deployment of solutions and programs, in order to reduce supply chain disruptions and maintain the flow of global trade.

These new digital solutions will support the shipping industry to weather the storm of lower profits, by cost-effectively managing cash flows for critical operating costs such as fuel, canal transits, and port services, while ensuring that suppliers have the assurance of payment and the ability to be paid faster.

Digital solutions with integrated workflows, including compliance verifications, associated data, and document compliance checks between buyers, suppliers, and global trade banks, can provide the digital infrastructure that facilitates the flow of transaction data and financing with efficient risk and cash management tools.

“With partnerships being key to solving industry issues, earlier this year, Pole Star partnered with one of the biggest global trade finance networks, the Marco Polo Network, to bring about a fully automated vessel sanctions screening solution to its members. Together, we are currently working on some exciting initiatives with Marco Polo - to be launched officially in the coming month - that will have a direct impact on improving maritime trade and supply chains, whilst eliminating many of the prevalent industry pain points” said Ring.

“The objective of the Marco Polo Network has always been about driving trade digitisation and eliminating friction in the financial supply chains while supporting trade compliance and risk management. Earlier this year, we teamed up with Pole Star to create combined solutions for the shipping industry, to equip the various parties with digital tools to combat the challenges they are facing in 2020 and beyond.

What happens now?

The need to digitise trade processes and adopt a more efficient, secure, cheaper, and easier real-time electronic documentation solution, whilst simultaneously providing access to financing, has never been more apparent than in the midst of a global pandemic-induced lockdown. By allowing suppliers to access payment within days instead of weeks or months, supply chain finance can give suppliers access to the working capital they need to stay in business in a highly challenging market.

Some examples of specific areas where the ability to leverage these kind of solutions can provide immediate value include, but are not limited to:

Canal transits: Current options for paying canal toll fees are problematic for shipping companies who must pay for expensive toll fees using cash in advance, and collect refunds for overages 30 days or more after transiting. By using a combination of the Marco Polo Payment commitment module, and screening and tracking services from PurpleTRAC, banks can provide shipping companies with financing programs that allow them to pay for transit toll fees over extended terms, with their bank using an easy-to-use digital platform, and significantly improve cash management capabilities in this challenging area.

Bunker fuel: The procurement and purchase of marine (bunker) fuels is the highest operating cost (~65%) for any ship owner or operator. In this current environment, many fuel providers can no longer extend credit to buyers, and/or ideally would like to be paid either up front or immediately upon approval of invoice. Fuel buyers, on the other hand, need at least 30 day payment terms or ideally 60-120 days to help manage liquidity. By using a combination of the Marco Polo Payment commitment module, and screening and tracking services from PurpleTRAC, participants can easily and securely share and verify required data as part of financing programs that provide desired benefits for buyers and suppliers, tailored to meet the compliance, workflow, and transactional requirements of bunker transactions.

It is inevitable that at some point in the future, we will face another similar crisis that disrupts the flow of documentary processes and, as such, the industry requires more than just a temporary fix. By digitising records, supply chains can be future-proofed to withstand other shocks down the line.