Expert opinion: Will sanctions kill the dollar?

Matthew Oresman and Henrietta Worthington, partner and associate at Pillsbury Winthrop Shaw Pittman LLP, take a look at why they think US policy represents the greatest threat to the world’s leading currency.

Over a decade after the financial crisis, the dollar remains the leading global currency – dominating all others in use for reserves and the settlement of trades. Rumours of its demise have been greatly exaggerated. However, trends are emerging that suggest the dominant position of the dollar will come under increasing pressure in the future, possibly including from the ever-expanding use of US sanctions.

The sources of pressure on the dollar’s dominant position are myriad. They include the stability of the Euro (especially as compared to the current instability of the pound); the adoption and use of crypto currencies; and the rise of China’s Renminbi (RMB) as a currency for international transactions. However, left to their own trajectories, these trends are unlikely to unseat the dollar. Instead, it is more likely that US policy could have a more significant detrimental effect on the dollar’s position than external forces.

The potential politicization of US monetary policy, including the Fed artificially decreasing or increasing interest rates under political pressure, is the greatest threat to the dollar’s position. Nevertheless, even today when there are numerous examples of President Trump pressuring the Fed to cut rates, the dollar remains the best safe-haven investment. In many regards, this reflects the core of the dollar’s strength: there are very few alternatives for a stable and safe currency underpinned by a strong, resilient economy.

However, another area of US policy – sanctions – may be unwittingly sparking demand for alternatives to which markets are starting to respond. In the final analysis, it is unlikely that sanctions will lead to the ultimate demise of the dollar, especially as many drivers of changes are linked to illicit, illegal, or otherwise risky behaviour that will never serve as the basis for a global economic paradigm shift. On the other hand, given the numerous simultaneous trends currently reshaping global trade and finance patterns, these “green shoots” cannot be ignored.

Strength of the dollar

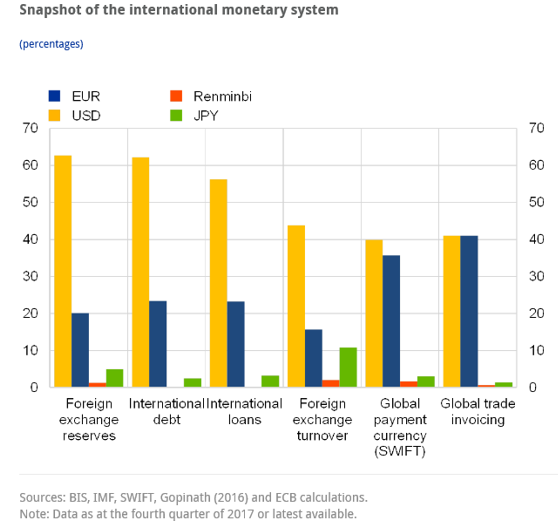

The dollar has continued its hegemony as the payment and foreign exchange currency of choice across the globe. In February this year, the European Central Bank announced that the dollar accounts for more than 60% of global debt[1]. It also dominates as the global international payment currency (accounting for over 40% of worldwide international payments) and as the foreign exchange reserve currency of choice (with over 60% of global reserves held in the dollar).

Coercive economic measures

The power of its strong currency has led the US to “weaponize” the dollar to assert economic pressure on its adversaries. The increasing use of this technique has received international attention, with the imposition of coercive measures becoming a cornerstone of US foreign policy, which has reached new heights under the Trump Administration. The imposition of sanctions, tariffs, export controls, investment restrictions, and trade negotiations has become synonymous with the Trump foreign policy.

One of the most widely used measures is economic sanctions, which enables the government to target foreign persons and entities and cut them off from accessing US commerce and finance. This is a tool that can be employed across sectors and geographies. US sanctions can be particularly powerful due to their “secondary” nature. The far-reaching impact of secondary sanctions means that anybody doing business in the US or even transacting in the dollar is caught within their grasp. Virtually all dollar denominated transactions pass through the US financial system in some way, even if just momentarily when they’re 'cleared.'

The US sanctioned around 1,500 Specially Designated Nationals and Blocked Persons (SDNs) in 2018 alone, almost 50 percent greater than in any other single year and representative of Trump’s tenacity on the economic battlefield. On top of that, the possible penalties for breaches of sanctions legislation are substantial, with fines regularly reaching into the millions, and even billions.

In addition to sparking demand from those involved in illicit activity, some nations have come to resent the US weaponization of the dollar and are pursing policies to develop global competitors.

Green shoots

Trump’s aggressive use of coercive economic tools has left other global economies looking for ways to reduce their reliance on the dollar. Trump has shown that the US is willing to use its dominant economic position to aggressively push policy objectives. Regardless of whether they agree on the specific policy aims of sanctions, many counties now believe the US can no longer be trusted to uphold global norms and standards; giving up its historical role as protector of the “global commons.” Accordingly, nations are now looking to protect their own interests and insulate themselves from what they view as capricious US action.

Given the size of the economy that relies on the Euro, it would appear to be the natural front runner in the challenge to the dollar’s global dominion. Furthermore, the Eurozone accounts for roughly the same amount of economic output as the US. On top of these inherent attributes, there have been calls for the Euro to be strengthened internationally. In his State of the Union Address 2018, Jean Claude Juncker vowed to “do more to allow our single currency to play its full role on the international scene” .

EU politicians have announced their intention to reduce their reliance on the dollar in respect of commodities pricing and other energy contracts. Juncker highlighted the “absurdity” of the fact that 80% of Europe’s energy imports are paid for in the dollar. This accounts for around 300 billion Euros each year, despite the fact that a mere 2% of imported energy is from the US. This is yet another indication that Europe wants to bolster the position of its currency in order to circumvent the US stranglehold.

The most evident example of this is the recent announcement by European representatives (and China and Russia) of the operationality of a channel (known as INSTEX) to process payments to Iran which operates outside of the US-dominated global financial system. The aim of the measure is to shield European companies from US sanction-related penalties following Trump’s withdrawal from the Joint Comprehensive Plan of Action and re-imposition of a sweeping sanctions regime against Iran in 2018. Whether this measure will succeed against the comprehensive US sanctions remains to be seen, but it is indicative of a perceived intention to challenge the dominance of Trump’s economic weapons. However, the measure is limited to the facilitation of trade believed to be non-sanctionable (including humanitarian, medical and agriculture products).

Despite these strong indications that the Euro is making a play for a larger global profile, statistics show that its use is on the decline, with its international role being at an all-time low.

Another possible blocker to the global strength of the Euro is the simultaneous rise of the RMB. China, like Europe, has been making a play to boost the international standing of its currency, though the RMB still only accounts for 2% of global payments. China has been stung in the past by US economic measures. The ongoing trade wars between the nations have come to a head and China is actively looking for ways to reduce its reliance on the dollar.

In 2015 (effective 2016), the International Monetary Fund deemed that the RMB met the criteria for the special drawing rights (SDR) basket alongside the dollar, the euro, the yen and the pound. China also now offers “panda bonds” which allow global businesses to raise debt in RMB and has attempted to raise the RMB’s profile in global energy markets with the launch of its first crude oil futures contract, which started trading in March last year.

The simultaneous rise of the Euro and RMB may prevent either from being able to sprout from their green shoots to become widely used alternatives, with each currency stalling the development of the other. Commentators have also highlighted other barriers to the growth of the RMB as being more entrenched. A recent report from the Center for a New American Security (CNAS) think-tank indicates that these include China’s strict capital controls and the weakness of its domestic institutions and the rule of law, which undermine its attempts to guarantee the RMB’s value

Another nation involved in the global rebellion against the dollar’s reign is Russia, which, like China, has been hampered by US sanctions. Both nations are hitting back by developing their own international payment systems. Russia began developing its system in 2014, following a wave of sanctions imposed in response to the Russian annexation of Crimea. Russia announced that over 400 companies have become members of the payment system as of March this year. The Chinese Cross-Border Interbank Payments System (CIPS) was launched in 2015. Both systems reduce reliance on SWIFT, which, whilst being a Belgian entity, is so embroiled in the US financial system (via US banks and the dollar) that it is exposed to US sanctions and generally implements US policy.

A further indicator of Russia’s commitment to subverting the might of the dollar is the central bank’s selling off of a reported 101 billion of dollars of its reserves in favour of other currencies. Vladimir Putin has spoken publicly of the need to “find alternative reserve currencies and create settlement systems independent of the dollar”. Anecdotal evidence suggests that there is an increasing trend in Russian companies (or companies with Russian exposure) switching to Euro trade and reducing use of the dollar. Earlier this year, Russia and China entered talks to agree to do more trade in their respective currencies. However, perceptions of Russia’s instability and a lack of confidence in the Russian system may prevent the ruble from significant growth at this stage.

A further green shoot is the development of new financial technologies. Systems such as blockchain may allow for the circumvention of the US financial system and enable payments in relation to sanctioned activities. These have been used in particular to facilitate illicit payments outside of the dollar-sphere in North Korea and Iran. Mobile payments are also on the rise, further reducing global exposure to the dollar. However, as with other examples above, the use of this alternative is being driven in a significant part by illicit activity, which may lay the seeds of its own demise or limited adoption.

The CNAS report also argues that a host of factors could conspire to weaken the impact of America’s economic policy arsenal over the longer term. Critically, it states that if the US attempts to reduce its economic, financial and trading connections with key overseas economies, “over time US coercive economic leverage over those economies will diminish”. Ironically, it also appears that a major threat to the dollar is US coercive economic policies themselves, which may ultimately undermine their own efficacy by creating incentives for alternatives.

Conversely, the underlying driver of the some of the demand for dollar alternatives may limit the adoption of these alternatives. On the one hand, national governments may view US sanctions policies as interfering with their own sovereign decisions. Those involved in illicit or risky behaviour may also view alternative currencies’ payment mechanisms as attractive tools to avoid detection. However, on the other hand, this does not mean that criminals and governments have the same objective in finding alternatives to the dollar. Both counties and their banks will have to assess whether alternative currencies and payment mechanisms entail higher risks for themselves or undermines law enforcement activity or commercial ties to the US.

In reality, policy priorities may cause countries to resist a change to the global financial order if it means creating more risk.

Conclusion

The US is increasingly relying on the strength of the dollar, coupled with the power of the US economy, and the dominance of US companies abroad, to achieve its foreign policy goals. The growing international profile of a number of other currencies and technology advances has led to speculation that there may be viable alternatives set to displace the dollar’s pole position.

Ultimately, it may be the excessive use of US economic measures that propels these alternatives to a position whereby they are able to pose a legitimate threat to the dollar. However, experts agree that in the short-term, the dollar will continue to reign supreme.