Credit where it's due: the new LMA Export Credit Agency Buyer Credit Facility Agreement explained

Kam Mahil, legal director at the Loan Market Association (LMA) and Ashley McDermott, senior associate at Clifford Chance, outline the methodology, and potential cost and efficiency benefits, of the LMA’s new form of facility agreement for use in export finance buyer credit transactions.

On 25 April 2018, the LMA published a new recommended form of facility agreement for use in export finance buyer credit transactions (the LMA ECA Buyer Credit Facility). The export finance market is a new area for the LMA and marks an important progression for the LMA suite of recommended form of documentation.

The view in the market is that the LMA ECA Buyer Credit Facility should bring down execution timelines and cost, drive efficiency and help introduce new borrowers to the benefits of using export finance.

Export credit agencies and buyer credit transactions

Export credit agencies (ECAs) play a vital role in supporting international trade. Countries provide officially supported export credits through ECAs in support of their exporters. ECAs can be government institutions or private companies operating on behalf of governments. The support they provide can include direct lending, credit insurance and/or financial guarantees as part of a financing.

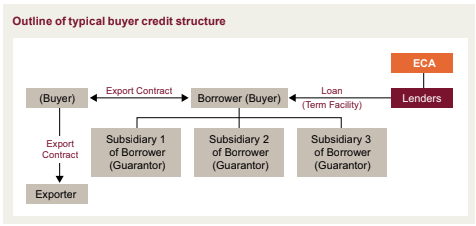

Under a buyer credit transaction, an exporter will typically enter into a contract for goods and/or services with an overseas buyer.

This purchase of exports may be financed by a facility agreement under which the lenders agree to provide finance to the buyer (which is also often the borrower under the facility agreement).

The lenders will either pay the exporter directly on behalf of the buyer via a utilisation of the facility, or will reimburse the buyer for payments previously made to the exporter.

Where a buyer credit transaction is supported by an ECA, the ECA in the exporting country would typically provide a guarantee and/or insurance to the lenders under a separate cover document to mitigate all or part of the risk of non-payment by the buyer under the facility.

This typical buyer credit structure is outlined in the diagram below.

Genesis of the LMA ECA Buyer Credit Facility

The documentation project was started in February 2017 in response to demand from the market to provide a form of ECA supported buyer credit agreement. For some time, it has been convention in the market to use boilerplate language from LMA documents when drafting ECA covered facility agreements. However, there are also divergences in approach to provisions in loan documentation between market participants on which it was thought to be helpful to get a common starting point in order to promote efficiency and liquidity in the market.

From an early stage it was recognised that the nature of ECA supported finance transactions was such that it would be very difficult to produce a document which was in any way ‘standard’. In particular, it was accepted that any document which was produced would need to be adapted so as to be tailored to the particular transaction structure, the particular ECA and the jurisdictional and export related specifics of each transaction. However, it was still felt that it would be a step forward in promoting the efficiency of the market if a document was produced which was a good starting point for discussions. Indeed, one of the perceived issues with accessing ECA support is that documentation requirements can be seen as onerous, particularly with different market participants taking different approaches and there being no standardised documentation in the market.

The LMA documentation project was also seen as being particularly desirable given the increased size of some ECA backed deals, which require syndication across the market. The focus of the documentation project was on the buyer credit market, which was felt to be the best starting point for an initial LMA export finance template.

Participants in the project

In putting together the LMA ECA Buyer Credit Facility, the LMA set up a working party. This consisted of experienced representatives from the banks (including in-house lawyers) and major City law firms active in the ECA market, along with certain export credit agencies. The LMA ECA Buyer Credit Facility is focused on the European market, and the LMA involved the major European ECAs as part of the project. The ECAs involved included SACE, Euler Hermes, UK Export Finance, Finnvera, EKF, SEK, Credendo and CESCE. The Berne Union, the global association for the export credit and investment insurance industry, participated in the project as an observer.

It is important to remember that there are differing approaches to review of documentation between ECAs. The LMA ECA Buyer Credit Facility is not intended to interfere with the positions taken by the ECAs or alter allocation of documentation risk. In addition, involvement of any ECA with the LMA ECA Buyer Credit Facility does not mean that an ECA has accepted the documentation or that it complies with their policies/documentation. However, the LMA ECA Buyer Credit Facility is a helpful step forward in producing a good starting point for negotiation and promoting efficiency in the export finance buyer credit market.

Basis and key assumptions of the LMA ECA Buyer Credit Facility

The LMA ECA Buyer Credit Facility takes as its starting point the LMA Unsecured Single Currency Term Facility Agreement for use in Developing Markets Transactions and seeks to provide for a typical export credit agency supported buyer credit structure.

As with all LMA documentation, the agreement has been produced on the basis of various assumptions made in order to avoid overcomplicating the document. These assumptions include that the ECA is not a party to the facility agreement (although could have certain rights under it) and would be providing cover to the lenders by way of guarantee or insurance policy (with no direct lending or fronting structure being assumed).

The agreement also assumes that the financing is tied export credit financing under the Organisation for Economic Cooperation and Development (OECD) Arrangement on Export Credits (also known as the OECD Consensus) and that the financing is not subject to any sector specific arrangements. By way of background, the OECD Consensus is intended to provide a framework for the orderly use of officially supported export credits. In practice, this means providing for a level playing field, whereby competition is based on the price and quality of the exported goods and not the financial terms provided. The OECD Consensus does this by placing limitations on the terms and conditions of officially supported export credits (e.g. minimum interest rates, risk fees and maximum repayment terms) and the provision of tied aid. The LMA ECA Buyer Credit Facility therefore includes footnotes directing users to the relevant requirements of the OECD Consensus, for example, in respect of the scheduled repayment profile, final maturity date and total commitments.

Whist the focus of the LMA project was on the European market and the European ECAs, the LMA ECA Buyer Credit Facility will be of application across all countries covered by the OECD Consensus. The participants to the Arrangement are: Australia, Canada, the European Union, Japan, Korea (Republic of), New Zealand, Norway, Switzerland and the United States. In addition, by its very nature, the LMA ECA Buyer Credit Facility is intended to be used on an international basis, as the ECAs will be providing support for lending to other countries (often into developing markets).

The LMA ECA Buyer Credit Facility is accompanied by a User Guide, which sets out further assumptions on which the agreement is based.

Key terms of the LMA ECA Buyer Credit Facility

Whilst buyer credit transactions have often used LMA documentation as a base, the LMA ECA Buyer Credit Facility contains additional clauses not found in other LMA documents that were deemed by the working party to be customary for ECA buyer credit facility agreements.

One such key clause contained in the LMA ECA Buyer Credit Facility is an ‘Isabella clause’, which is a standard feature of buyer credit transactions. The intention of an Isabella clause is to ensure, amongst other things, that the obligations, rights and responsibilities under the export contract are separate from those under the facility agreement.

The LMA ECA Buyer Credit Facility also contains an ECA ‘override’ clause, which is intended to ensure that the provisions of the finance documents do not conflict with the ECA cover document and that the finance parties are not obliged to do anything that conflicts with the ECA cover document or the requirements of the ECA. There is also a clause to protect the finance parties if they act in accordance with the instructions of the ECA.

Another key feature of the LMA ECA Buyer Credit Facility is that utilisations can be structured either as disbursements, being paid directly to the exporter, or reimbursement to the buyer, in which case evidence of receipt of payment will be required from the exporter. These drawing mechanics are typical to an ECA buyer credit transaction. The LMA ECA Buyer Credit Facility also provides that financing of any ECA premium is permitted and is capable of being financed via the proceeds of the initial loan rather than on a pro rata basis under each loan.

The LMA ECA Buyer Credit Facility also provides that if the ECA support is suspended, terminated or ceases to be in full force and effect up to the agreed level and scope of cover then a mandatory prepayment event will occur. The definition of an ECA mandatory prepayment event is one that needs to be considered on a case-by-case basis.

In terms of the agency role, ECAs often require that the ECA cover document be entered into between the ECA and a specific person (but not each of the lenders). This is likely to be an agent on behalf of the lenders. As a result, this agency role may involve additional obligations regarding compliance with the terms of the ECA cover document. As a breach of such obligations can potentially impact on the ECA cover for each lender, the agent role is central to the ECA cover. There is no single preferred approach to agent provisions in relation to ECA cover. The role may be designated as either a ‘facility agent’ or an ‘ECA agent’, which may sometimes be documented as a separate role. Therefore, the LMA ECA Buyer Credit Facility provides the option for a separate ECA agent role where required.

Finally, the LMA ECA Buyer Credit Facility is governed by English law. This is typical for export credit transactions. Export credit transactions backed by ECAs are rarely governed by local law.

What next?

As with all LMA documentation projects, the LMA ECA Buyer Credit Facility will be kept under review, and in particular will be reviewed once it has been used on a number of transactions and practice has settled in the market. It is indeed already being used on transactions.

It was also agreed with the working party that, whilst there would be no specific environmental or social action clauses included in the agreement at the moment (as these are deal/export credit agency/lender specific), the working party would consider looking at any language being produced by the OECD working group on this area in due course.