TXF Export Finance Industry Survey 2019

TXF’s Export Finance Industry Report 2019 is here. The survey, which comprises the views of 259 individual senior export finance practitioners at banks, ECAs, importers, exporters, insurers, lawyers and alternative financiers, is by far our most comprehensive yet...

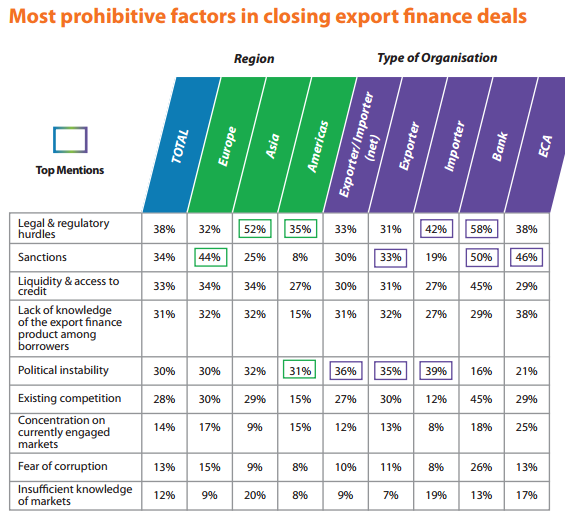

The overall market sentiment in TXF's third edition of its export finance industry report was clear. The export finance community is experiencing much the same trends and challenges as it did last year – legal and regulatory hurdles unsurprisingly topped the bill for the most prohibitive factors to doing business receiving 36% of the total vote, with bankers most likely to protest the issue. Sanctions, the second greatest challenge to ECA-backed deals, took 34% of the vote and also saw particularly heavy criticism from banks (50%).

However, despite the ongoing headwinds facing the industry, respondents remained in general optimistic about the state of the market, giving it an average rating of 6.75 out of 10. Fifty-four percent of respondents scored in neutral territory (4-7), with 39% scoring positively (8-10) and 7% negatively (1-3).

The ECA chart toppers

Of the ECAs that were rated, Euler Hermes (42%) and UK Export Finance (UKEF) (34%) were reported by survey respondents as the two most commonly used ECAs. Italy’s ECA, SACE, was the third most common ECA to be tapped by exporters (30%), however just 5% of the respondents described it as being the best (see full 45-page market survey). And given SACE is meant to be one of most staffed, slickest and active traditional OECD ECAs, the findings are surprising. However, this particular market sentiment may be linked to the fact SACE scored second lowest on pricing (6.24) when rated from one (extremely dissatisfied) to ten (extremely satisfied) by respondents. It is important to note, due to the lack of deals disclosed by Sinosure (TXF only captures deals closed with international banks), China's ECA does not feature higher in the ECA charts.

ECA bank excellence

Banks are thought to be performing well, according to their market counterparts. Seventy-one percent of respondents thought that banks’ export finance skills and expertise were improving. And 91% thought that the banks were currently taking adequate care when considering risks in transactions. Good news for the most active ECA banks.

Private insurance on the rise

There was a marginal uptick in the use of the private insurance in the market over the past 12 months. Forty-six percent of respondents said they had increased their use of the product, compared to 45% reporting their use had stayed the same while the remaining 9% said it had used it less than the year before. Fifty-six percent of those surveyed said they were likely to use the product over the next 12 months, compared to 14% saying they wouldn’t and 30% unsure. The majority (42%) agreed that the pricing structures were transparent and easy to understand, compared to 30% disagreeing and 28% unsure.

Africa shows good growth

Africa topped the rankings for regional export activity, with the 44% of respondents reporting growth in the continent over the past 12 months. The region saw $16.1 billion of ECA-supported deals over the course of the year, according to TXF Data. Asia came in second with 42%, followed by the Middle East (39%), the Americas (36%) and Europe (30%). It was a similar picture in regards to expectations for growth over the coming year. However, this time Asia (53%) just pipped Africa (51%) for auspicious forecasts, followed once again by the Middle East (45%), the Americas (41%) and Europe (31%).

Pricing: The song remains the same

Like the general state of the ECA market, the majority of respondents (36%) said the cost of ECA debt (margin plus fees (no premium)) remained the same over the past 12 months (see page six or pie chart below), with 28% reporting an increase, 21% a decline, and 17% saying they were unsure. The finding represent a levelling off of a downward trend in pricing in recent years. For example, just over half of respondents in last year’s survey reported a decrease in pricing, as did two-thirds of those interviewed the year before.

But when drilling down to specific pricing ballparks, survey participants said pricing was most likely to fall in the range of 51-100bps over Libor (19.5%), closely followed by 101-150bps (16.8%) and 151-200bps over Libor (14%) (see Figure 14 below). Deal pricing revealed by TXF News in 2018 reflected the report’s findings. For example, Reliance Jio infocomm’s K-sure-backed deal in India last year priced as low as 75bp (82bp all-in), while Bapco in Bahrain, a multi-sourced financing for an oil refinery, priced between 100-150bp (excluding premiums).

Looking forward over the coming year, 62% of respondents predicted ECA premium pricing to stay the same, compared to 26% forecasting an increase and 12% a decrease.

To purchase the full 45-page TXF Export Finance Industry Survey 2019 report please contact dominik.kloiber@txfmedia.com, or if you are a subscriber to TXF Essentials please download the market report here.