Risky business: Where are we now in world trade weaponization?

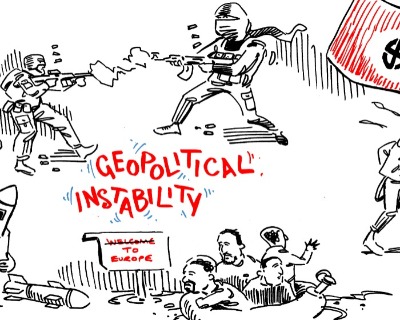

TXF and Coriolis Technologies’ country risk index digs deep into the strategic trends in militarisation of trade and in this overview, Rebecca Harding, CEO of Coriolis Technologies sees weaponization of trade in unexpected areas. This is the first in the series of seven insights.

TXF: The Country Risk Index covers 157 countries, but here we're focusing on what's happening overall in terms of the weaponization of trade. What's the data telling us?

Rebecca Harding (RH): The data does three things other indicators don't do. It looks at strategic trends. It looks at dual use goods trade between countries and the rate at which that's changing above two standard deviations so, significant changes in dual use goods. It also looks at significant changes in arms trade and then it has a media feed as well that's looking particularly at the rhetorical weaponization and the use of language around trade and the politicisation of trade. These are things that don't happen somewhere else. And it's very much trade specific.

Obviously what we're seeing is a general increase globally in political tensions and a lot of this is driven by US bilateralism. We're seeing an increase in US-China tensions and an increase in US-Russia tensions, Saudi-EU, US-Iran. And, interestingly, US-Central America which is something that we've really picked up this time.

It is centred around this bilateralism but we're beginning to see it have an impact, for example, on the growing militarisation of parts of the world that you really wouldn't expect. So we're seeing an increase in arms trade and an increase in dual-use goods trade in countries like Australia and Canada. Also along the Baltic states but the European countries that border the Baltic states are Finland Norway Denmark and Sweden in particular. We've seen a significant increase in the risks attached and the militarisation there.

The other thing that we're seeing as part of the global picture is the increase in populism. Now there's been a lot of research about this in the last few months [asking] where is all of this populism coming from across the world. And what we do is we measure regime type, so we measure in the news and in the data that we see as well the extent to which populism is becoming important.

And regimes are becoming more oppressive or more populist as a result. And we've seen some big increases in that over the last few months and we're projecting that this will get worse in the EU, in Asia and in Africa but also as well in Central America. So this is all very worrying because it's a politicisation again of some of the basics of politics and economics.

TXF: These are happening in tandem then, the weaponization and the and the populism?

RH: And if you look at what TXF and Coriolis have done in the past together, we've looked at how this populism can feed into a general militarization. What that does is it increases the general perception that there is a risk 'out there' and increases the potential for miscalculation. So that's what we're actually measuring and it's going through the political and the political trade system. And the final thing that we're seeing is that an increase in terror threats as well.

Some of it is in Europe. We've got countries in Europe that are affected by this but then we're also seeing an increase in Latin America and that's very worrying because obviously Colombia and countries that have terrorist groups that are becoming more active that's a bit of a concern as well.

TXF: We're seeing countries that we don't normally see, like Australia, Denmark moving into areas that are weaponizing. How are you managing to pick that up in the data?

RH: We create a foreign policy index which is based on the strategic use of trade as a tool for coercion.

It measures arms trade, it measures dual-use goods trade and then it measures the general nervousness in the media as well. It measures those three things and it puts them all together. The tension in the news, combined with visible and statistically significant increases in trade in either arms or dual-use or both is what's creating that picture.

And what we're seeing is countries like Australia becoming more weaponized in terms of what they're doing and some of that comes from the South China Seas and concerns around what's happening there.

TXF: Also who's actually financing this weaponization? Are we able to see much of this coming through the data in terms of banks/government funding, etc?

RH: It's a really important question. What we're what we're seeing is two things. There's another sector which is 'commodities not elsewhere specified'. Now we think that is probably government funded because that trade is not specified, it's stuff that can be legitimately hidden. It's legal trade but it just doesn't want to be classified. [It's] highly correlated with key political events. For example, you can see Russia-Iranian trade around missile tests and things like that. There's a lot that we're seeing around that. We think that's strategic trade and that's funded by governments. But banks do fund some of this and will be quite explicit about it.

But the key thing for a bank is to understand where they are supporting government policy and for governments actually to be quite explicit on where they need the private sector to fund these things because otherwise you end up in a situation like we had in 2012 or we had in 2014 where it's quite clear that banks are funding stuff that actually then the governments clamp down on. So some kind of clarity between the two is very important.

TXF: What we're going to do now is break down into our regional sectors where we can actually analyse in more depth the really interesting topics you've raised.